![]()

![]() On Monday November 19, US stock market saw a sharp drop, led by a selloff in stocks of big technology companies, after Apple announced a cut in production of its latest products, the iPhone XS, the iPhone XS Max and the iPhone XR, due to lower-than-expected demand.

On Monday November 19, US stock market saw a sharp drop, led by a selloff in stocks of big technology companies, after Apple announced a cut in production of its latest products, the iPhone XS, the iPhone XS Max and the iPhone XR, due to lower-than-expected demand.

![]() Also on Monday, Carlos Ghosn, the chairman of the Japanese carmaker Nissan, was arrested and charged with fraudulent financial actions including under-reporting his income and using company’s assets for personal needs.

Also on Monday, Carlos Ghosn, the chairman of the Japanese carmaker Nissan, was arrested and charged with fraudulent financial actions including under-reporting his income and using company’s assets for personal needs.

![]() On Thursday November 22, the European Commission approved a draft declaration on the post-Brexit relationship between the EU and the UK, which outlined a deep and broad future partnership between the two economies regarding the trade and economic cooperation, law enforcement and security issues.

On Thursday November 22, the European Commission approved a draft declaration on the post-Brexit relationship between the EU and the UK, which outlined a deep and broad future partnership between the two economies regarding the trade and economic cooperation, law enforcement and security issues.

![]() Over the last week, oil prices saw an extended loss over the past months, sliding to the lowest point of this year due to the looming concerns of oversupply after reports on increased US oil inventories and the November oil output from Saudi Arabia.

Over the last week, oil prices saw an extended loss over the past months, sliding to the lowest point of this year due to the looming concerns of oversupply after reports on increased US oil inventories and the November oil output from Saudi Arabia.

![]()

![]()

![]() German CPI will be released on Thursday November 29 and is expected to come in at 2.4% YoY.

German CPI will be released on Thursday November 29 and is expected to come in at 2.4% YoY.

![]() On the same day, Thursday November 29, France GDP growth will be released, at an expected rate of 1.5% YoY.

On the same day, Thursday November 29, France GDP growth will be released, at an expected rate of 1.5% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 19/11/18

Notice:

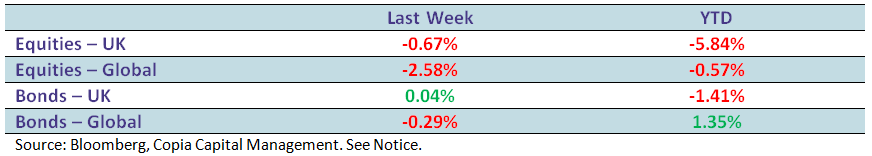

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.