![]()

![]() On Tuesday November 13, the UK and the EU reached an agreement on Brexit that if there is no long-term deal in place by the end of transition period in July 2020, the UK can either extend the transition period or use the Irish backstop solution, which will keep Northern Ireland with the EU single market and customs union.

On Tuesday November 13, the UK and the EU reached an agreement on Brexit that if there is no long-term deal in place by the end of transition period in July 2020, the UK can either extend the transition period or use the Irish backstop solution, which will keep Northern Ireland with the EU single market and customs union.

![]() The agreement reached on Tuesday between the UK and the EU was approved by the majority of the cabinet on Wednesday November 14, whilst four ministers resigned as they believe backstop arrangement is a threat to the integrity of the UK.

The agreement reached on Tuesday between the UK and the EU was approved by the majority of the cabinet on Wednesday November 14, whilst four ministers resigned as they believe backstop arrangement is a threat to the integrity of the UK.

![]() Also on Wednesday, Italy announced to support its current budget plan after the European Commission rejected it, which proposed a budget deficit at 2.4% of Italy’s GDP and the economic growth at 1.5% in 2019.

Also on Wednesday, Italy announced to support its current budget plan after the European Commission rejected it, which proposed a budget deficit at 2.4% of Italy’s GDP and the economic growth at 1.5% in 2019.

![]() Bitcoin dropped sharply over the last week, with the loss amounting to more than 32% on Thursday November 15, trading at the lowest point of the year.

Bitcoin dropped sharply over the last week, with the loss amounting to more than 32% on Thursday November 15, trading at the lowest point of the year.

![]()

![]()

![]() Japan CPI will be released on Wednesday November 21 and is expected to come in at 1.4% YoY.

Japan CPI will be released on Wednesday November 21 and is expected to come in at 1.4% YoY.

![]() On Friday November 23, German GDP growth will be released, at an expected rate of 1.1% YoY.

On Friday November 23, German GDP growth will be released, at an expected rate of 1.1% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 12/11/18

Notice:

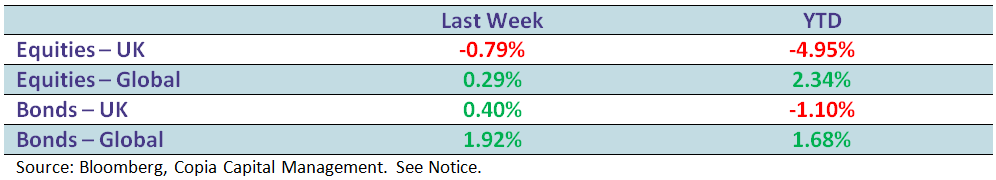

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.