![]()

![]() On Tuesday October 23, the European Commission rejected the draft budget plan for the Italian government for 2019, which proposed to increase the deficit up to 2.4% of Italy’s GDP in 2019, in contrast to 0.8% promised by the previous government.

On Tuesday October 23, the European Commission rejected the draft budget plan for the Italian government for 2019, which proposed to increase the deficit up to 2.4% of Italy’s GDP in 2019, in contrast to 0.8% promised by the previous government.

![]() Also on Tuesday, Saudi Arabia announced at the Future Investment Initiative conference that it signed deals worth more than $50bn with companies from eight countries to invest in various sectors including oil, pharmaceuticals, infrastructure etc.

Also on Tuesday, Saudi Arabia announced at the Future Investment Initiative conference that it signed deals worth more than $50bn with companies from eight countries to invest in various sectors including oil, pharmaceuticals, infrastructure etc.

![]() Tesla released its earnings report for the third fiscal quarter on Wednesday October 24, showing a 150% increase in company’s net income YoY and quarterly automotive revenue jumped by 158% compared to the same quarter last year.

Tesla released its earnings report for the third fiscal quarter on Wednesday October 24, showing a 150% increase in company’s net income YoY and quarterly automotive revenue jumped by 158% compared to the same quarter last year.

![]() On Thursday October 25, the ECB decided to keep the current monetary policies, which means the benchmark interest rate will stay at 0%, the base deposit rate at -0.4% and the monthly asset purchase capped at €15bn.

On Thursday October 25, the ECB decided to keep the current monetary policies, which means the benchmark interest rate will stay at 0%, the base deposit rate at -0.4% and the monthly asset purchase capped at €15bn.

![]()

![]()

![]() The US trade balance for August will be announced on Friday November 2, with an expected deficit at $52.0bn.

The US trade balance for August will be announced on Friday November 2, with an expected deficit at $52.0bn.

![]() On the same day November 2, the US unemployment rate will be released and is expected to be at 3.7%..

On the same day November 2, the US unemployment rate will be released and is expected to be at 3.7%..

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/10/18

Notice:

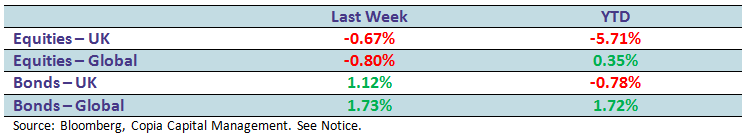

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future