![]()

- Michel Barnier, the EU’s chief negotiator, dealt a major blow to Theresa May’s hopes of starting the process of discussions around trade talks after stating, “We’ve reached a state of deadlock which is very disturbing”. The Pound (£) reacted negatively to this statement and fell against both the Euro (€) and the Dollar ($).

- The International Monetary Fund (IMF) raised their world growth forecast to 3.7% for 2018, the highest level since the financial crisis. However, it singled out Britain as a notable exception, stating the negative effects on the UK economy are beginning to show.

- S. President Donald Trump is expected to call for measures cracking down on what he sees as Iran’s aggression in the Middle East by refusing to certify that the multinational accord to curb Iran’s nuclear program sufficiently serves U.S. interests, though he is expected to stop short of abandoning it.

- After Britain introduced a higher minimum wage last year, the number of low-paid workers in the UK has seen its sharpest drop in almost 40 years, falling from 20.7% to 19.3%.

![]()

![]()

- On Tuesday 17 October we will see the release of UK CPI YoY with the market expecting this to come in at 3%.

- On Tuesday 17 October we will also see the release of US industrial production MoM with the market expecting to see an increase of 0.3%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/17

Notice:

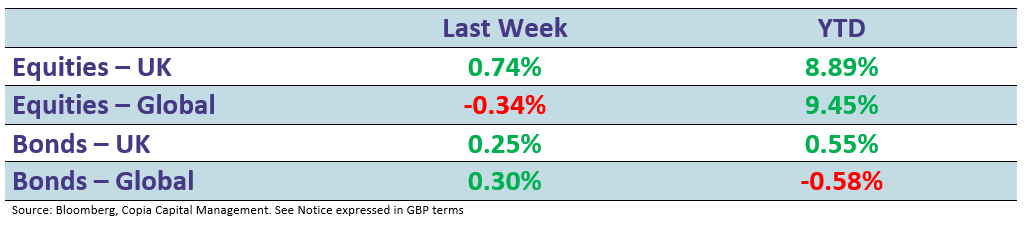

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.