![]()

![]() On Monday October 1, the US and Canada agreed to replace the NAFTA with a new trilateral deal named as the United States-Mexico-Canada Agreement, which will offer freer market access and fair trade to grow the economies.

On Monday October 1, the US and Canada agreed to replace the NAFTA with a new trilateral deal named as the United States-Mexico-Canada Agreement, which will offer freer market access and fair trade to grow the economies.

![]() On Thursday October 4, the yield on 10-year Treasury bond hit a seven-year high and the yield on 30-year Treasury bond reached its highest level since 2014, following the release of the US job market data, which was stronger than economists’ expectation.

On Thursday October 4, the yield on 10-year Treasury bond hit a seven-year high and the yield on 30-year Treasury bond reached its highest level since 2014, following the release of the US job market data, which was stronger than economists’ expectation.

![]() On Thursday, a report from Bloomberg Business Week was published to claim that Chinese government has been spying over networks of hundreds of US companies including Amazon and Apple, by inserting microchips on their server motherboards during assembly, which are supplied and assembled by Supermicro.

On Thursday, a report from Bloomberg Business Week was published to claim that Chinese government has been spying over networks of hundreds of US companies including Amazon and Apple, by inserting microchips on their server motherboards during assembly, which are supplied and assembled by Supermicro.

![]() On Thursday, Theresa May made an announcement in her speech on the Conservative Party conference that the UK government will end the austerity programme and increase public spending after Brexit.

On Thursday, Theresa May made an announcement in her speech on the Conservative Party conference that the UK government will end the austerity programme and increase public spending after Brexit.

![]()

![]()

![]() China trade balance for September will be announced on Friday October 12, with an expected surplus at $24.55bn.

China trade balance for September will be announced on Friday October 12, with an expected surplus at $24.55bn.

![]() The US CPI will be released on Thursday October 11 and is expected to come in at 2.4% YoY.

The US CPI will be released on Thursday October 11 and is expected to come in at 2.4% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/18

Notice:

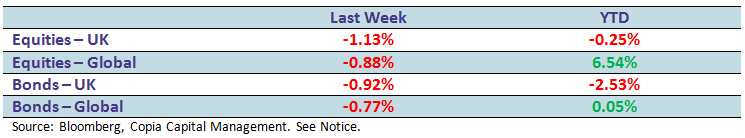

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future