![]()

![]() The US – China trade war escalated further, with the US announcing additional 10% tariffs on $200 billion worth of Chinese imports on Monday September 17 and China retaliating by levying a 5% to 10% tax on $60 billion worth of US goods on Tuesday September 18.

The US – China trade war escalated further, with the US announcing additional 10% tariffs on $200 billion worth of Chinese imports on Monday September 17 and China retaliating by levying a 5% to 10% tax on $60 billion worth of US goods on Tuesday September 18.

![]() UK CPI for August was released on Wednesday September 19 and came in at 2.7%, surprisingly higher than economists’ estimates of 2.4%.

UK CPI for August was released on Wednesday September 19 and came in at 2.7%, surprisingly higher than economists’ estimates of 2.4%.

![]() On Wednesday September 18, the US Energy Information Administration (EIA) reported a decrease by 2.1 million barrels of US crude oil inventories for the week ending September 14.

On Wednesday September 18, the US Energy Information Administration (EIA) reported a decrease by 2.1 million barrels of US crude oil inventories for the week ending September 14.

![]() The Pound rallied against the USD to a two-month high on Thursday September 20, trading at $1.325.

The Pound rallied against the USD to a two-month high on Thursday September 20, trading at $1.325.

![]()

![]()

![]() UK GDP growth will be released on Friday September 28, at an expected rate of 1.3% YoY.

UK GDP growth will be released on Friday September 28, at an expected rate of 1.3% YoY.

![]() On the same day Friday September 28, Japan’s unemployment rate for August will be released and is expected at 2.4%.

On the same day Friday September 28, Japan’s unemployment rate for August will be released and is expected at 2.4%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/08/18

Notice:

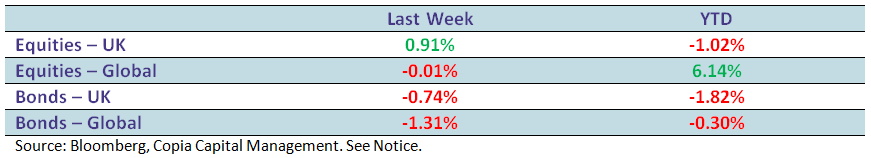

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future