![]()

![]() On Wednesday August 29, Michel Barnier expressed the opinion that the EU is prepared to offer a post-Brexit partnership with the UK, which has never been formed with any other third country. However, he added a day after that a no-deal Brexit is still possible.

On Wednesday August 29, Michel Barnier expressed the opinion that the EU is prepared to offer a post-Brexit partnership with the UK, which has never been formed with any other third country. However, he added a day after that a no-deal Brexit is still possible.

![]() On Wednesday, the US reported a decline in crude oil inventories by 2.6 million barrels, to 405.8 million barrels in the week ending August 24, showing evidence of a tightening oil market, which has pushed oil price to a monthly high.

On Wednesday, the US reported a decline in crude oil inventories by 2.6 million barrels, to 405.8 million barrels in the week ending August 24, showing evidence of a tightening oil market, which has pushed oil price to a monthly high.

![]() On Monday August 27, Toyota announced an investment of $500 million in a project to develop self-driving cars with Uber.

On Monday August 27, Toyota announced an investment of $500 million in a project to develop self-driving cars with Uber.

![]() On Friday August 31, Coca-Cola announced an acquisition deal of Costa Limited, the coffee chain from Whitbread, which is valued at $5.1 billion.

On Friday August 31, Coca-Cola announced an acquisition deal of Costa Limited, the coffee chain from Whitbread, which is valued at $5.1 billion.

![]()

![]()

![]() US trade balance for July will be announced on Wednesday September 5, with an expected deficit of $47.0bn.

US trade balance for July will be announced on Wednesday September 5, with an expected deficit of $47.0bn.

![]() US unemployment rate will be released on Friday September 7 and is expected at 3.8%.

US unemployment rate will be released on Friday September 7 and is expected at 3.8%.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 20/08/18

Notice:

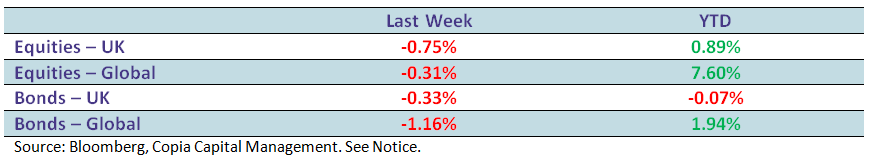

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.