![]()

![]() Turkey announced retaliatory tariffs on tobacco, cars and alcohol imported from the US and reached a decision to boycott US electronic products after Trump tweeted on doubling the import tax on Turkish steel and aluminium

Turkey announced retaliatory tariffs on tobacco, cars and alcohol imported from the US and reached a decision to boycott US electronic products after Trump tweeted on doubling the import tax on Turkish steel and aluminium

![]() The UK CPI increased by 2.5% in July, a jump from a steady growth rate of 2.4% for the previous three months and the first rise since November.

The UK CPI increased by 2.5% in July, a jump from a steady growth rate of 2.4% for the previous three months and the first rise since November.

![]() On Tuesday, Alphabet announced its investment of $375 million in a healthcare start-up, Oscar Health, which used big data to create an efficient insurance claim system on a tech platform.

On Tuesday, Alphabet announced its investment of $375 million in a healthcare start-up, Oscar Health, which used big data to create an efficient insurance claim system on a tech platform.

![]() Walmart released its quarterly earnings on Thursday, with revenue reported to be $128 billion for the second quarter, a 3.8% growth YoY, driven by e-commerce sales as well as consumers’ in-store spending.

Walmart released its quarterly earnings on Thursday, with revenue reported to be $128 billion for the second quarter, a 3.8% growth YoY, driven by e-commerce sales as well as consumers’ in-store spending.

![]()

![]()

![]() The Japanese CPI will be released on Friday August 24 and is expected to come in at 1.0% YoY.

The Japanese CPI will be released on Friday August 24 and is expected to come in at 1.0% YoY.

![]() On the same day, Friday August 24, German GDP growth for the second quarter will be released, at an expected growth rate of 2.0% YoY.

On the same day, Friday August 24, German GDP growth for the second quarter will be released, at an expected growth rate of 2.0% YoY.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/18

Notice:

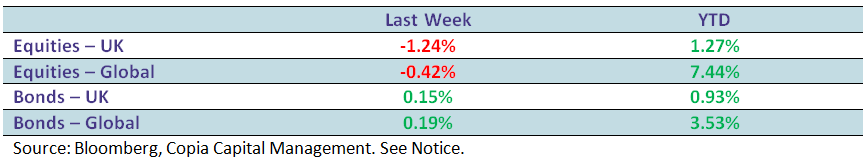

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.