![]()

![]() The new Brexit plan from the white paper published on Tuesday 24 July intends to keep the UK under European jurisdictions until the end of the transition period of 2020.

The new Brexit plan from the white paper published on Tuesday 24 July intends to keep the UK under European jurisdictions until the end of the transition period of 2020.

![]() In the US-EU talk on Wednesday, an agreement was reached towards zero tariffs on industrial goods between the two economies, both parties adding that they will further negotiate and work on US tariffs imposed on steel and aluminium imported from the EU.

In the US-EU talk on Wednesday, an agreement was reached towards zero tariffs on industrial goods between the two economies, both parties adding that they will further negotiate and work on US tariffs imposed on steel and aluminium imported from the EU.

![]() The European Central Bank announced that interest rates will remain unchanged at the monetary policy meeting and it is expected to stay at the present level until the summer of 2019.

The European Central Bank announced that interest rates will remain unchanged at the monetary policy meeting and it is expected to stay at the present level until the summer of 2019.

![]() On Wednesday, Facebook shares dropped more than 20% after the release of its earnings report, which showed slowing revenue growth, much below analysts’ expectations.

On Wednesday, Facebook shares dropped more than 20% after the release of its earnings report, which showed slowing revenue growth, much below analysts’ expectations.

![]()

![]()

![]() The Eurozone CPI will be released on Tuesday 31 July and is expected to come in at 2.0% YoY.

The Eurozone CPI will be released on Tuesday 31 July and is expected to come in at 2.0% YoY.

![]() The BoE interest rate decision will be revealed on Thursday 2 August, with a rate hike from current 0.5% to 0.75% expected.

The BoE interest rate decision will be revealed on Thursday 2 August, with a rate hike from current 0.5% to 0.75% expected.

![]()

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/06/18

Notice:

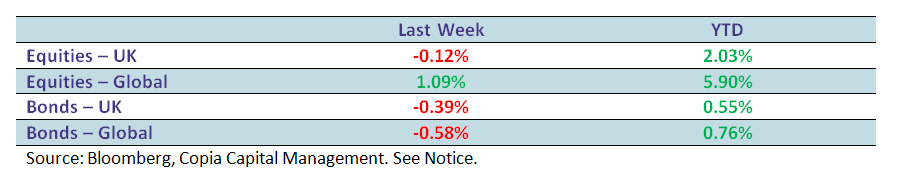

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.