![]()

![]() BOE governor Mark Carney expressed great confidence in the UK economy in his speech on Thursday, further increasing the market expectation of an interest rate hike in August.

BOE governor Mark Carney expressed great confidence in the UK economy in his speech on Thursday, further increasing the market expectation of an interest rate hike in August.

![]() The money laundering investigation by US authorities into Glencore Plc triggered a selloff in its shares, leading to a loss of more than £5bn from its market value. The company has now started its $1bn (£755m) stock repurchase scheme.

The money laundering investigation by US authorities into Glencore Plc triggered a selloff in its shares, leading to a loss of more than £5bn from its market value. The company has now started its $1bn (£755m) stock repurchase scheme.

![]() Monday 2 July saw the ONS for the first time try to quantify the scale of the UK shadow banking sector, with a conservative estimate of £2.2trn.

Monday 2 July saw the ONS for the first time try to quantify the scale of the UK shadow banking sector, with a conservative estimate of £2.2trn.

![]() US tariffs on $50bn worth Chinese goods came into force on Friday, with China implementing retaliatory tariffs on some US imports.

US tariffs on $50bn worth Chinese goods came into force on Friday, with China implementing retaliatory tariffs on some US imports.

![]()

![]()

![]() The UK trade balance for May will be announced on Tuesday 10 July, with an expected deficit of £3,150m.

The UK trade balance for May will be announced on Tuesday 10 July, with an expected deficit of £3,150m.

![]() The US CPI for June will be released on Thursday 12 July and is expected to come in at 2.9% YoY.

The US CPI for June will be released on Thursday 12 July and is expected to come in at 2.9% YoY.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/06/18

Notice:

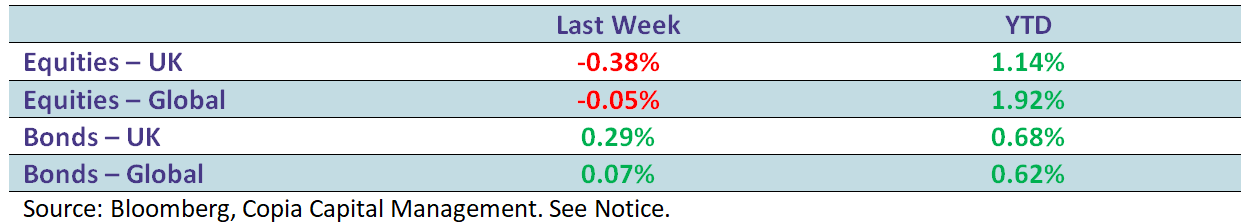

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.