![]()

![]() The Fed raised the benchmark interest rate by 25 bps and has forecast two more hikes for 2018. The current Fed Funds rate stands at 2.00% and the Fed expects GDP growth to be 2.8% for 2018.

The Fed raised the benchmark interest rate by 25 bps and has forecast two more hikes for 2018. The current Fed Funds rate stands at 2.00% and the Fed expects GDP growth to be 2.8% for 2018.

![]() The European Central Bank planned to reduce its monthly asset purchases from €30bn to €15bn after September 2018 and end the QE programme entirely by the end of this year.

The European Central Bank planned to reduce its monthly asset purchases from €30bn to €15bn after September 2018 and end the QE programme entirely by the end of this year.

![]() AT&T won approval to complete its $85bn acquisition of Time Warner, which was long delayed by the federal government on concerns about the decrease in competition in the paid TV market.

AT&T won approval to complete its $85bn acquisition of Time Warner, which was long delayed by the federal government on concerns about the decrease in competition in the paid TV market.

![]() Bitcoin dropped 4.6% on Tuesday after a tweet from South Korean cryptocurrency exchange Coinrail confirming a cyber-attack.

Bitcoin dropped 4.6% on Tuesday after a tweet from South Korean cryptocurrency exchange Coinrail confirming a cyber-attack.

![]()

![]()

![]() The Japanese Trade Balance for May will be announced on Monday June 18, with an expected trade deficit of ¥250bn.

The Japanese Trade Balance for May will be announced on Monday June 18, with an expected trade deficit of ¥250bn.

![]() The Japanese CPI for May will be released on Friday June 22 and is expected to come in at 0.6% YoY.

The Japanese CPI for May will be released on Friday June 22 and is expected to come in at 0.6% YoY.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/18

Notice:

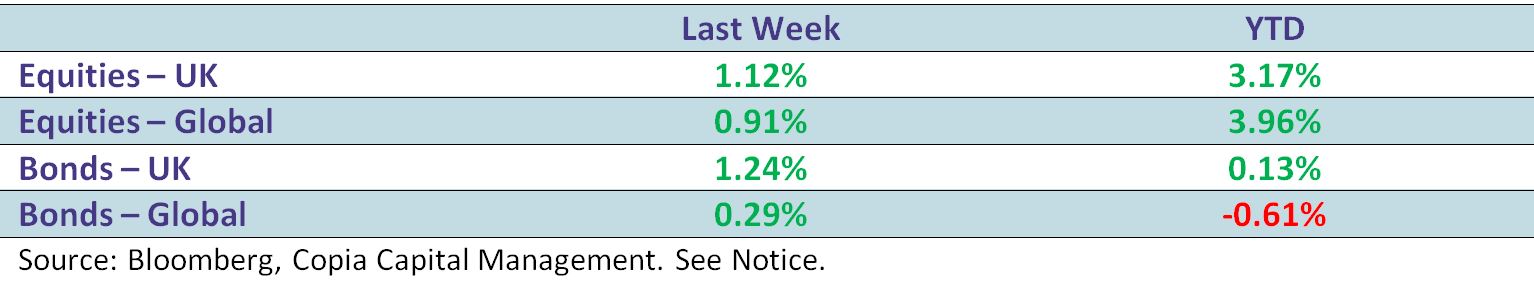

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.