![]()

![]() Trump announced that the U.S. will withdraw from the Iran nuclear deal and will resume economic sanctions against the country, saying the current agreement is “a rotten structure”.

Trump announced that the U.S. will withdraw from the Iran nuclear deal and will resume economic sanctions against the country, saying the current agreement is “a rotten structure”.

![]() Vodafone is finalising its €18.4bn acquisition of Liberty Global’s assets in Germany, the Czech Republic, Hungary and Romania in an attempt to expand its broadband businesses in Europe.

Vodafone is finalising its €18.4bn acquisition of Liberty Global’s assets in Germany, the Czech Republic, Hungary and Romania in an attempt to expand its broadband businesses in Europe.

![]() The Bank of England decided to keep interest rates at 0.5% as the economic growth has been slower than expected. BOE has decreased its GDP growth forecast from 1.8% to 1.4% for 2018.

The Bank of England decided to keep interest rates at 0.5% as the economic growth has been slower than expected. BOE has decreased its GDP growth forecast from 1.8% to 1.4% for 2018.

![]() Nestlé will pay Starbucks $7.1bn for the right to sell and distribute Starbucks’ products in supermarkets and elsewhere.

Nestlé will pay Starbucks $7.1bn for the right to sell and distribute Starbucks’ products in supermarkets and elsewhere.

![]()

![]()

![]() UK unemployment rate will be released on Tuesday May 15 and is expected at 4.2%.

UK unemployment rate will be released on Tuesday May 15 and is expected at 4.2%.

![]() Japan CPI for April will be released on Friday May 18 and is expected to come in at 0.7% YoY.

Japan CPI for April will be released on Friday May 18 and is expected to come in at 0.7% YoY.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/04/18

Notice:

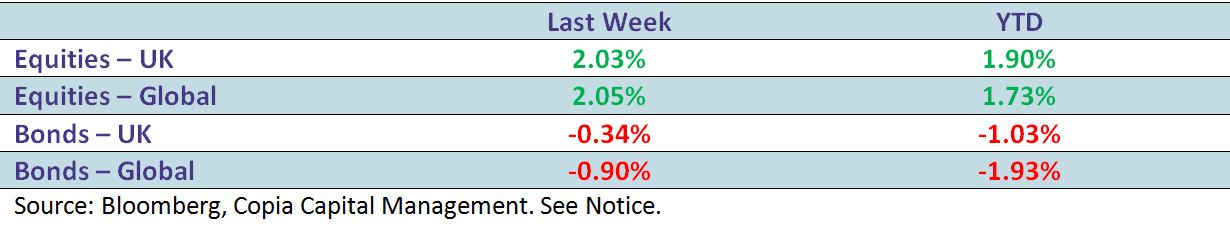

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.