![]()

![]() In the congressional hearing on the Facebook Inc. data breach scandal, the company’s CEO Mark Zuckerberg conceded that regulation changes were inevitable, but no consensus was reached on any specific privacy legislation or business model changes.

In the congressional hearing on the Facebook Inc. data breach scandal, the company’s CEO Mark Zuckerberg conceded that regulation changes were inevitable, but no consensus was reached on any specific privacy legislation or business model changes.

![]() China laid out a timetable for opening its financial market, which included raising foreign ownership limits to 51% in securities, fund management and insurance companies in the coming months, and fully removing the cap after three years.

China laid out a timetable for opening its financial market, which included raising foreign ownership limits to 51% in securities, fund management and insurance companies in the coming months, and fully removing the cap after three years.

![]() IMF Chief Christine Lagarde, while remaining optimistic on the global growth outlook, warned of “darker clouds” in the global economy when speaking in Hong Kong about fading fiscal stimulus and rising interest rates.

IMF Chief Christine Lagarde, while remaining optimistic on the global growth outlook, warned of “darker clouds” in the global economy when speaking in Hong Kong about fading fiscal stimulus and rising interest rates.

![]()

![]()

![]() China will reveal the GDP growth on Tuesday April 17, expected at 6.8% YoY.

China will reveal the GDP growth on Tuesday April 17, expected at 6.8% YoY.

![]() The U.K. CPI will be released on Wednesday April 18, with a forecasted rate of 2.7% YoY.

The U.K. CPI will be released on Wednesday April 18, with a forecasted rate of 2.7% YoY.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 16/04/18

Notice:

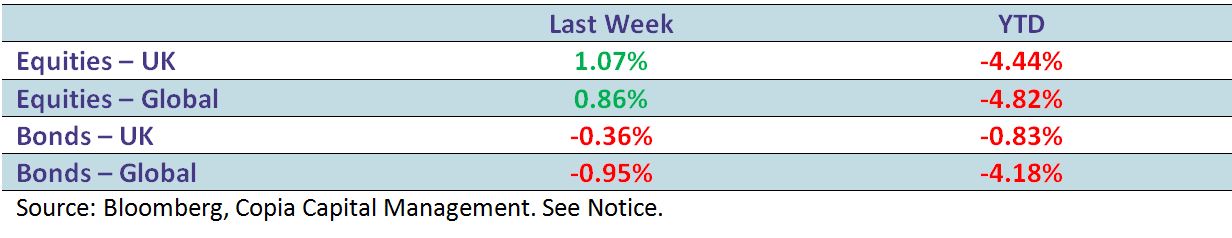

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.