![]()

![]() Trump proposed to raise an additional $100 billion tariff on Chinese imports after China said it would levy 25% tariffs on imports of 106 U.S. products including soybeans, automobiles, chemicals and aircraft, retaliating against the $50 billion tariffs imposed by the US over Chinese high-tech goods.

Trump proposed to raise an additional $100 billion tariff on Chinese imports after China said it would levy 25% tariffs on imports of 106 U.S. products including soybeans, automobiles, chemicals and aircraft, retaliating against the $50 billion tariffs imposed by the US over Chinese high-tech goods.

![]() Barclays’s credit rating was lowered by Moody’s to one level above junk on profitability concerns after the bank separated its retail operations from investment banking, following the ring-fencing rule that will come into force next year.

Barclays’s credit rating was lowered by Moody’s to one level above junk on profitability concerns after the bank separated its retail operations from investment banking, following the ring-fencing rule that will come into force next year.

![]() Facebook’s CEO Mark Zuckerberg admitted about failing to protect user data privacy but defended the company’s advertising business model and said the scandal had not had “any meaningful impact” on its business.

Facebook’s CEO Mark Zuckerberg admitted about failing to protect user data privacy but defended the company’s advertising business model and said the scandal had not had “any meaningful impact” on its business.

![]() Eurozone CPI rose in line with expectation to 1.4% from 1.2% YoY in March. The data is said to have benefited from the increased prices of holidays and accommodations during Easter.

Eurozone CPI rose in line with expectation to 1.4% from 1.2% YoY in March. The data is said to have benefited from the increased prices of holidays and accommodations during Easter.

![]()

![]()

![]() U.S. CPI will be released on Wednesday April 11, which is expected to rise to 2.3% YoY in March from 2.2% in February.

U.S. CPI will be released on Wednesday April 11, which is expected to rise to 2.3% YoY in March from 2.2% in February.

![]() On the same day, Wednesday April 11, U.K. Trade Balance for February will come out, with an expected trade deficit of £2.8 billion, narrowed from previous £3.074 billion in January.

On the same day, Wednesday April 11, U.K. Trade Balance for February will come out, with an expected trade deficit of £2.8 billion, narrowed from previous £3.074 billion in January.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/18

Notice:

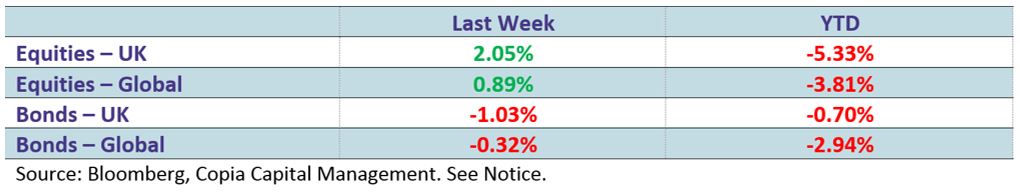

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.