![]()

![]() The Fed raised the benchmark interest rate by 25 bps and implied at least two more hikes in 2018 and three more hikes in 2019. China’s central bank raised the 7-day reverse repo rate by 5 bps following the Fed’s move.

The Fed raised the benchmark interest rate by 25 bps and implied at least two more hikes in 2018 and three more hikes in 2019. China’s central bank raised the 7-day reverse repo rate by 5 bps following the Fed’s move.

![]() The UK and EU agreed to a 21-month transition period during which the UK will remain an EU member state with all rights and obligations, in order to avoid a cliff-edge Brexit, that would be damaging to both economies.

The UK and EU agreed to a 21-month transition period during which the UK will remain an EU member state with all rights and obligations, in order to avoid a cliff-edge Brexit, that would be damaging to both economies.

![]() Trump confirmed the imposition of a $50 billion tariff against China over intellectual-property violations, which is likely to trigger retaliation from Beijing and cause a global trade war.

Trump confirmed the imposition of a $50 billion tariff against China over intellectual-property violations, which is likely to trigger retaliation from Beijing and cause a global trade war.

![]() The data-analysis firm Cambridge Analytica gathered data from more than 50 million Facebook profiles and was accused of misusing the data to aid Donald Trump’s presidential campaign.

The data-analysis firm Cambridge Analytica gathered data from more than 50 million Facebook profiles and was accused of misusing the data to aid Donald Trump’s presidential campaign.

![]()

![]()

![]() US GDP will be released on Wednesday March 28, which is expected at 2.3% annualised QoQ.

US GDP will be released on Wednesday March 28, which is expected at 2.3% annualised QoQ.

![]() UK GDP will be released on Thursday March 29, with a forecast rate of 1.4% YoY

UK GDP will be released on Thursday March 29, with a forecast rate of 1.4% YoY

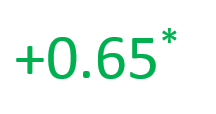

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/02/18

Notice:

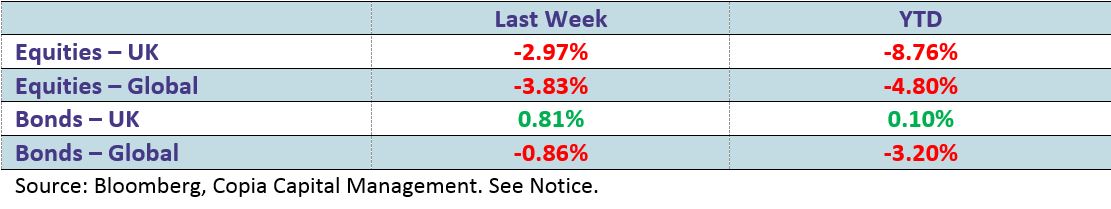

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.