![]()

![]() US president Trump failed to take strong action on gun control in response to the US school shootings in Florida last week, which left 17 people dead.

US president Trump failed to take strong action on gun control in response to the US school shootings in Florida last week, which left 17 people dead.

![]() Apple is in talks to buy long-term supplies of cobalt directly from miners. Cobalt is a key ingredient in mobile phone batteries and the move was prompted based on fears of a shortage due to the electric vehicle boom.

Apple is in talks to buy long-term supplies of cobalt directly from miners. Cobalt is a key ingredient in mobile phone batteries and the move was prompted based on fears of a shortage due to the electric vehicle boom.

![]() The weekly pay for workers in the U.K increased by 2.5% in the last quarter of 2017. The U.K. employment rate also rose to 75.2% and included fewer foreign nationals in the workforce.

The weekly pay for workers in the U.K increased by 2.5% in the last quarter of 2017. The U.K. employment rate also rose to 75.2% and included fewer foreign nationals in the workforce.

![]() The White House Press Secretary, Sarah Sanders, acknowledged Russia’s attempt to interfere with the 2016 presidential election, but denied its impact on Trump’s victory.

The White House Press Secretary, Sarah Sanders, acknowledged Russia’s attempt to interfere with the 2016 presidential election, but denied its impact on Trump’s victory.

![]()

![]()

![]() The annualised GDP QoQ for the U.S. will be released on Wednesday February 28 and is expected to drop from 2.6% to 2.5%.

The annualised GDP QoQ for the U.S. will be released on Wednesday February 28 and is expected to drop from 2.6% to 2.5%.

![]() On Thursday March 1, the US personal income MoM will be released and is expected to increase by 0.2%, from previous 0.4%.

On Thursday March 1, the US personal income MoM will be released and is expected to increase by 0.2%, from previous 0.4%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 12/02/18

Notice:

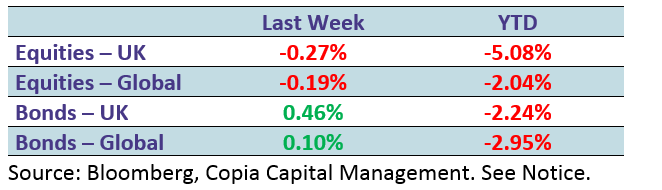

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.