![]() U.S. Job growth exceeds forecasts as unemployment rates continue to fall, with nonfarm payrolls rising by 943,000 in the previous month and unemployment rates dropping to 5.4%.

U.S. Job growth exceeds forecasts as unemployment rates continue to fall, with nonfarm payrolls rising by 943,000 in the previous month and unemployment rates dropping to 5.4%.

![]() Chile which is the world’s largest copper producer has seen its annual inflation rise to 4.5% as reported by the national statistics office, this is the highest level seen since March 2016.

Chile which is the world’s largest copper producer has seen its annual inflation rise to 4.5% as reported by the national statistics office, this is the highest level seen since March 2016.

![]() The UK house price index has increased by 0.40% when compared to the previous month, leaving prices up by 7.6% when compared to the same period last year.

The UK house price index has increased by 0.40% when compared to the previous month, leaving prices up by 7.6% when compared to the same period last year.

![]() U.S. June wholesale inventories growth estimates were revised higher for June from 0.8% to 1.1% in response to increased consumer spending over the same period.

U.S. June wholesale inventories growth estimates were revised higher for June from 0.8% to 1.1% in response to increased consumer spending over the same period.

![]() German consumer price index data to be released on Wednesday August 11th, expected 3.8% YoY.

German consumer price index data to be released on Wednesday August 11th, expected 3.8% YoY.

![]() U.S consumer price index data to be released on Wednesday August 11th, expected 5.3% YoY.

U.S consumer price index data to be released on Wednesday August 11th, expected 5.3% YoY.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/21

Notice:

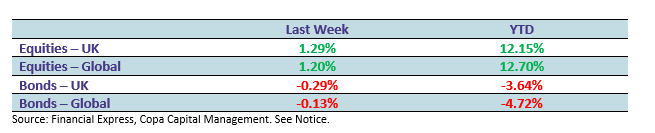

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.