![]() Last week saw a significant sell off in Chinese assets sparked by Chinese authorities publishing new regulation regarding the education tech sector, spooking international investors.

Last week saw a significant sell off in Chinese assets sparked by Chinese authorities publishing new regulation regarding the education tech sector, spooking international investors.

![]() The European CenU.S GDP expanded at an annualised rate of 6.5% in the first quarter of 2021 sharply missing the median estimate of 8.4% as the effects of supply chain constraints continue to be felt throughout the world.

The European CenU.S GDP expanded at an annualised rate of 6.5% in the first quarter of 2021 sharply missing the median estimate of 8.4% as the effects of supply chain constraints continue to be felt throughout the world.

![]() German inflation rose 3.8% in July YoY according to a provisional report from the Federal statistics office (Destatis). On a monthly basis this was a 0.9% gain from the previous month in which CPI stood at 2.3%.

German inflation rose 3.8% in July YoY according to a provisional report from the Federal statistics office (Destatis). On a monthly basis this was a 0.9% gain from the previous month in which CPI stood at 2.3%.

![]() Eurozone inflation has risen above the ECB target of 2% to 2.2% with further peaks expected later in the year. ECB policy makers have re-affirmed their commitment to easy monetary policy with the factors driving inflation seen as transitory.

Eurozone inflation has risen above the ECB target of 2% to 2.2% with further peaks expected later in the year. ECB policy makers have re-affirmed their commitment to easy monetary policy with the factors driving inflation seen as transitory.

![]() Japanese manufacturing PMI to be announced on Sunday August 1st.

Japanese manufacturing PMI to be announced on Sunday August 1st.

![]() Eurozone manufacturing PMI data to be released on Monday August 2nd, expected 62.6

Eurozone manufacturing PMI data to be released on Monday August 2nd, expected 62.6

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 19/07/21

Notice:

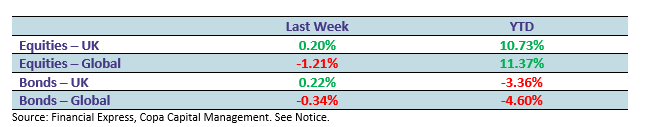

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.