![]() OPEC and its allies have struck a deal to increase oil production to meet demand of the recovering global economy. This will reduce the risk of a supply squeeze and reduce the risk of an inflationary oil price spike.

OPEC and its allies have struck a deal to increase oil production to meet demand of the recovering global economy. This will reduce the risk of a supply squeeze and reduce the risk of an inflationary oil price spike.

![]() The European Central Bank pledged on Thursday to keep interest rates at record lows for even longer to meet the elusive 2% inflation target, which even in the current environment has eluded the Eurozone.

The European Central Bank pledged on Thursday to keep interest rates at record lows for even longer to meet the elusive 2% inflation target, which even in the current environment has eluded the Eurozone.

![]() U.K. retail sales surged unexpectedly in June with the volume of goods sold online and in shops rising by 0.5% from the previous month, The Office for National Statistics had expected a 0.1% drop following an unprecedented jump in April following widespread store reopening’s.

U.K. retail sales surged unexpectedly in June with the volume of goods sold online and in shops rising by 0.5% from the previous month, The Office for National Statistics had expected a 0.1% drop following an unprecedented jump in April following widespread store reopening’s.

![]() Chile’s central baJapan’s core consumer prices rose 0.20% in June from a year earlier to mark the fastest annual pace in over a year, driven largely by increasing fuel costs.

Chile’s central baJapan’s core consumer prices rose 0.20% in June from a year earlier to mark the fastest annual pace in over a year, driven largely by increasing fuel costs.

![]() Fed interest rate decision is to be announced on Wednesday July 28th, expected 0.25%

Fed interest rate decision is to be announced on Wednesday July 28th, expected 0.25%

![]() Eurozone CPI data to be released on Friday July 30th, expected 2.0% YoY

Eurozone CPI data to be released on Friday July 30th, expected 2.0% YoY

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 19/07/21

Notice:

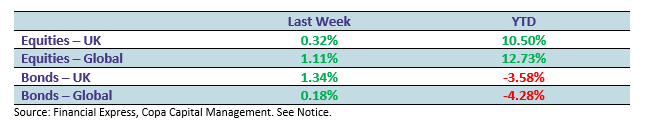

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.