![]() U.S. import prices increased solidly in June as supply chain bottlenecks persisted, the latest indication that inflation could remain elevated for some time yet amid strong domestic demand and fiscal stimulus.

U.S. import prices increased solidly in June as supply chain bottlenecks persisted, the latest indication that inflation could remain elevated for some time yet amid strong domestic demand and fiscal stimulus.

![]() Output at U.S. factories dipped unexpectedly by 0.1% in June as vehicle production dropped amid continuing semiconductor shortages across the globe.

Output at U.S. factories dipped unexpectedly by 0.1% in June as vehicle production dropped amid continuing semiconductor shortages across the globe.

![]() U.S. inflation rose to a thirteen year high of 5.4% in the twelve months to the end of June up from 5% in the previous month.

U.S. inflation rose to a thirteen year high of 5.4% in the twelve months to the end of June up from 5% in the previous month.

![]() Chile’s central bank has increased its benchmark interest rate by 25 basis points to 0.75% on Wednesday, as a rapid vaccination program has helped the world’s top copper producer resume economic activity.

Chile’s central bank has increased its benchmark interest rate by 25 basis points to 0.75% on Wednesday, as a rapid vaccination program has helped the world’s top copper producer resume economic activity.

![]() U.S. jobless data to be released on Thursday 22nd July.

U.S. jobless data to be released on Thursday 22nd July.

![]() Eurozone Manufacturing Purchasing Managers Index data to be released on Friday July 23, expected 62.5. Previous index value was 63.4 as of 1st July.

Eurozone Manufacturing Purchasing Managers Index data to be released on Friday July 23, expected 62.5. Previous index value was 63.4 as of 1st July.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/06/21

Notice:

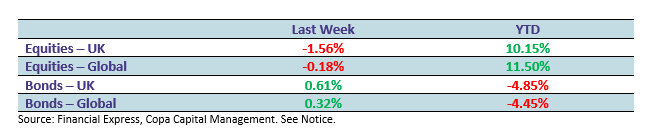

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.