![]()

![]() The Fed left the interest rate unchanged at 1.5% and acknowledged strong economic growth with inflation expected to reach the target of 2%. US Treasury yields touched new highs, while equity markets pulled back sharply on initial reports of company earnings missing estimates.

The Fed left the interest rate unchanged at 1.5% and acknowledged strong economic growth with inflation expected to reach the target of 2%. US Treasury yields touched new highs, while equity markets pulled back sharply on initial reports of company earnings missing estimates.

![]() Daimler warned that profit growth will be brought to a halt by an on-going spend on new technology. Global car makers announced plans on making heavy investment in electric and autonomous driving

Daimler warned that profit growth will be brought to a halt by an on-going spend on new technology. Global car makers announced plans on making heavy investment in electric and autonomous driving

![]() Facebook has had its first-ever decline in North American daily active users but promised to focus on user experience which pushed the stock price even higher.

Facebook has had its first-ever decline in North American daily active users but promised to focus on user experience which pushed the stock price even higher.

![]()

![]()

![]() China is going to reveal its Trade Balance for January on Thursday 8 February. The positive balance is expected to experience a decrease to $52.35bn.

China is going to reveal its Trade Balance for January on Thursday 8 February. The positive balance is expected to experience a decrease to $52.35bn.

![]() Also on Thursday 8 February, Bank of England is expected to keep the official bank rate unchanged at 0.5%.

Also on Thursday 8 February, Bank of England is expected to keep the official bank rate unchanged at 0.5%.

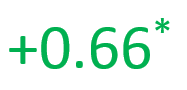

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/01/18

Notice:

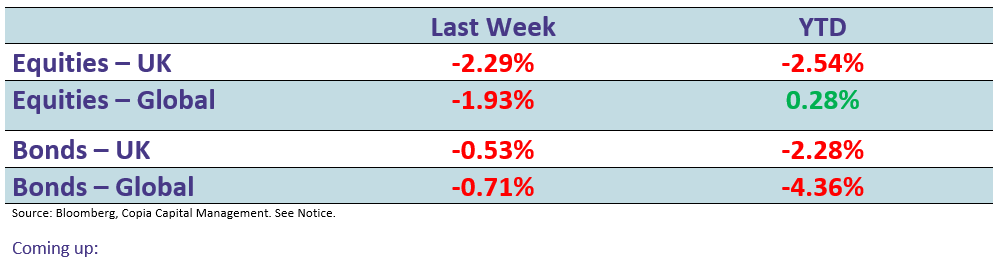

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.