![]() The Bank of England on Thursday unanimously voted to maintain current monetary policy decisions, with the main lending rate at a historic low of 0.1%. But has vowed to monitor rising inflation in the UK economy.

The Bank of England on Thursday unanimously voted to maintain current monetary policy decisions, with the main lending rate at a historic low of 0.1%. But has vowed to monitor rising inflation in the UK economy.

![]() Oil prices continued their march higher during the last week with futures trading at highs above $74 a barrel on the back of expectations of future supply constraints over the coming quarters placing further inflationary pressure on economies.

Oil prices continued their march higher during the last week with futures trading at highs above $74 a barrel on the back of expectations of future supply constraints over the coming quarters placing further inflationary pressure on economies.

![]() UK consumer sentiment has held at post-COVID highs as reported by GfK’s consumer confidence index which has been unchanged since May and is at its highest since March 2020.

UK consumer sentiment has held at post-COVID highs as reported by GfK’s consumer confidence index which has been unchanged since May and is at its highest since March 2020.

![]() Manufacturing in Singapore has jumped by 30% YoY, its biggest gain in 10 years according to official data released on Friday.

Manufacturing in Singapore has jumped by 30% YoY, its biggest gain in 10 years according to official data released on Friday.

![]() UK GDP data for Q1 2021 to be released on Wednesday June 30

UK GDP data for Q1 2021 to be released on Wednesday June 30

![]() German CPI data to be released on Tuesday June 29. Expected 2.30% YoY.

German CPI data to be released on Tuesday June 29. Expected 2.30% YoY.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/05/21

Notice:

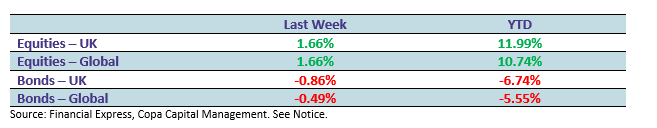

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.