![]() The US Federal Reserve has announced it will begin to unwind corporate credit holdings it acquired last year through an emergency lending facility launched last year at the height of the pandemic to provide liquidity and support markets.

The US Federal Reserve has announced it will begin to unwind corporate credit holdings it acquired last year through an emergency lending facility launched last year at the height of the pandemic to provide liquidity and support markets.

![]() Oil has resumed its price increase with settlement prices not seen since 2018. OPEC+ alliance forecasting a tight global crude market.

Oil has resumed its price increase with settlement prices not seen since 2018. OPEC+ alliance forecasting a tight global crude market.

![]() US jobless claims have dipped below 400,000 for the first time since the beginning of the pandemic according to data released by the Department of Labour on Thursday 3rd June.

US jobless claims have dipped below 400,000 for the first time since the beginning of the pandemic according to data released by the Department of Labour on Thursday 3rd June.

![]() The US services industry has improved in May in comparison to previous months with the PMI at an all time high of 64%. A 1.3% increase on the previous month.

The US services industry has improved in May in comparison to previous months with the PMI at an all time high of 64%. A 1.3% increase on the previous month.

![]() Swiss CPI data to be released on Monday June 7. Expected 0.30% YoY.

Swiss CPI data to be released on Monday June 7. Expected 0.30% YoY.

![]() Eurozone quarterly employment data is to be released on Tuesday June 8.

Eurozone quarterly employment data is to be released on Tuesday June 8.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/05/21

Notice:

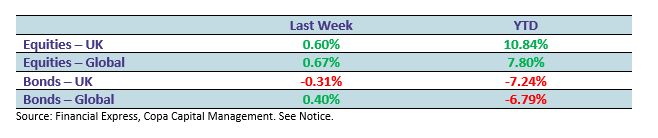

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.