![]() China has moved to ban financial institutions and payment companies from providing services related to cryptocurrency transactions, and warned investors against speculative crypto trading..

China has moved to ban financial institutions and payment companies from providing services related to cryptocurrency transactions, and warned investors against speculative crypto trading..

![]() ECB President Christine Lagarde remains adamant that inflation rises seen this year are transitory and would be expected to return to pre-pandemic levels in 2022.

ECB President Christine Lagarde remains adamant that inflation rises seen this year are transitory and would be expected to return to pre-pandemic levels in 2022.

![]() Over the last volatile week of trading investors have bought inflation protection and have sold some tech stocks particularly sensitive to inflation as was seen on BofA’s weekly fund flow data.

Over the last volatile week of trading investors have bought inflation protection and have sold some tech stocks particularly sensitive to inflation as was seen on BofA’s weekly fund flow data.

![]() UK retail spending sored as the economy has re-opened in April following official data released last Friday. Sales volumes in April jumped 9.2% month on month – twice the average industry forecast.

UK retail spending sored as the economy has re-opened in April following official data released last Friday. Sales volumes in April jumped 9.2% month on month – twice the average industry forecast.

![]() German GDP will be announced on Tuesday May 25, expected at -3.0% YoY

German GDP will be announced on Tuesday May 25, expected at -3.0% YoY

![]() US 7 year note auction to take place on Thursday May 27.

US 7 year note auction to take place on Thursday May 27.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 13/05/21

Notice:

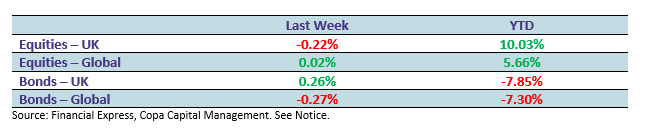

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.