![]()

![]() Last week, riots emerged in Belfast and Derry between the loyalists to the UK and nationalists in Northern Ireland caused by the long-standing disputes between the UK and the EU over the Northern Ireland Protocol.

Last week, riots emerged in Belfast and Derry between the loyalists to the UK and nationalists in Northern Ireland caused by the long-standing disputes between the UK and the EU over the Northern Ireland Protocol.

![]() The Institute for Supply Management (ISM) reported on Monday April 5 that US services PMI reached a historical high of 63.7% in March, up 8.4% from February due to the lifting of Covid restrictions in the country.

The Institute for Supply Management (ISM) reported on Monday April 5 that US services PMI reached a historical high of 63.7% in March, up 8.4% from February due to the lifting of Covid restrictions in the country.

![]() On Wednesday April 8, the US Fed released the minutes of the latest monetary policy meeting, which remained dovish, reiterating that the pandemic will continue to pose considerable risks to the outlook and intended not to change their interest rate policy or bond purchasing programme.

On Wednesday April 8, the US Fed released the minutes of the latest monetary policy meeting, which remained dovish, reiterating that the pandemic will continue to pose considerable risks to the outlook and intended not to change their interest rate policy or bond purchasing programme.

![]() On Thursday April 8, the US sent a proposal on a new global corporate taxation to 135 countries, which would require about 100 big multinational companies to pay taxes based on their revenues generated in each country.

On Thursday April 8, the US sent a proposal on a new global corporate taxation to 135 countries, which would require about 100 big multinational companies to pay taxes based on their revenues generated in each country.

![]()

![]()

![]() US CPI for March will be announced on Tuesday April 13, with an expectation of 2.5% YoY.

US CPI for March will be announced on Tuesday April 13, with an expectation of 2.5% YoY.

![]() China GDP growth for 1Q21 will be released on Friday April 16, at an expected rate of 18.3% YoY.

China GDP growth for 1Q21 will be released on Friday April 16, at an expected rate of 18.3% YoY.

![]()

+0.71*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/21

Notice:

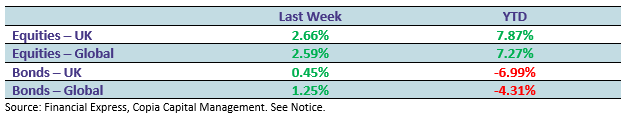

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.