![]()

![]() Speaking at Davos, Uber CEO says “A child born today may never need to learn to drive.” He went on to say that over 1.3 million deaths are caused by road accidents each year and adoption of autonomous vehicles globally could help make roads safer.

Speaking at Davos, Uber CEO says “A child born today may never need to learn to drive.” He went on to say that over 1.3 million deaths are caused by road accidents each year and adoption of autonomous vehicles globally could help make roads safer.

![]() Taking a step towards protectionism, US President Trump imposed steep tariffs on imported solar panels and washing machines, having a direct impact on South Korean and Chinese manufacturers.

Taking a step towards protectionism, US President Trump imposed steep tariffs on imported solar panels and washing machines, having a direct impact on South Korean and Chinese manufacturers.

![]() Multi-millionaire, Jerome Powell, was approved by the US Senate as the next Fed chairman – one of the World’s most important economics jobs.

Multi-millionaire, Jerome Powell, was approved by the US Senate as the next Fed chairman – one of the World’s most important economics jobs.

![]() Pound Sterling punched through the 1.40 handle vs. the US Dollar, reaching pre-Brexit levels, but the rally was primarily driven by US Dollar weakness compared to Pound strength.

Pound Sterling punched through the 1.40 handle vs. the US Dollar, reaching pre-Brexit levels, but the rally was primarily driven by US Dollar weakness compared to Pound strength.

![]()

![]()

![]() Eurozone GDP will be released on Thursday 1 February and is expected to be 2.2% growth YoY.

Eurozone GDP will be released on Thursday 1 February and is expected to be 2.2% growth YoY.

![]() On Friday 2 February, US non-farm payrolls are expected to come in at 178,000, while the unemployment rate is expected at 4.1%.

On Friday 2 February, US non-farm payrolls are expected to come in at 178,000, while the unemployment rate is expected at 4.1%.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/01/18

Notice:

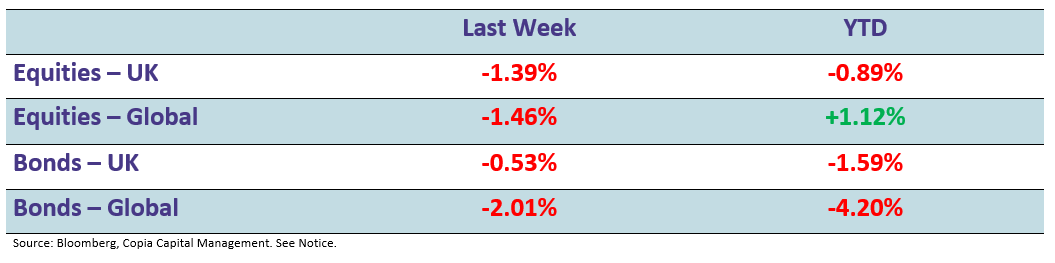

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.