![]()

![]() Biden unveiled his $2 trn infrastructure bill on Wednesday March 30, which includes investments of about $650bn for rebuilding critical infrastructures, $400bn for elderly and disabled care, $300bn for building homes, and $300bn for developing manufacturing.

Biden unveiled his $2 trn infrastructure bill on Wednesday March 30, which includes investments of about $650bn for rebuilding critical infrastructures, $400bn for elderly and disabled care, $300bn for building homes, and $300bn for developing manufacturing.

![]() French Chancellor Angela Merkel announced on Wednesday that the government will suspend using AstraZeneca vaccine for people under 60 due to the report of 31 blood clot cases after people receiving the vaccine.

French Chancellor Angela Merkel announced on Wednesday that the government will suspend using AstraZeneca vaccine for people under 60 due to the report of 31 blood clot cases after people receiving the vaccine.

![]() On Thursday March 31, French Prime Minister Jean Castex announced an extension on coronavirus restrictions in France to May 3 due to the resurging Covid cases across the country. Amid the 3rd wave of coronavirus, Germany, Poland and Ukraine have also implemented stricter coronavirus measures.

On Thursday March 31, French Prime Minister Jean Castex announced an extension on coronavirus restrictions in France to May 3 due to the resurging Covid cases across the country. Amid the 3rd wave of coronavirus, Germany, Poland and Ukraine have also implemented stricter coronavirus measures.

![]() Archegos Capital Management, owned by the multi-billionaire financier Bill Hwang, defaulted on margin calls after using high leverages via total return swaps on stocks, which plunged last week. The lenders including Credit Suisse and Nomura are now facing multi-billion-dollar losses.

Archegos Capital Management, owned by the multi-billionaire financier Bill Hwang, defaulted on margin calls after using high leverages via total return swaps on stocks, which plunged last week. The lenders including Credit Suisse and Nomura are now facing multi-billion-dollar losses.

![]()

![]()

![]() On Tuesday April 6, China Caixin Service PMI will be released and is expected to come in at 52.1.

On Tuesday April 6, China Caixin Service PMI will be released and is expected to come in at 52.1.

![]() China CPI for March will be announced on Friday April 9, with an expectation of 0.2% YoY.

China CPI for March will be announced on Friday April 9, with an expectation of 0.2% YoY.

![]()

+0.71*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/21

Notice:

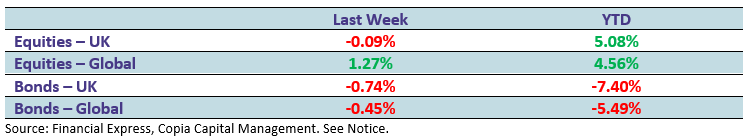

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.