![]()

![]() On Wednesday March 24, the European Commission introduced new rules to tighten the Covid-19 vaccine export, requiring the member states to assess if the exports will pose threats on the vaccine supplies within the bloc. However, the EU leaders refused to enforce the rules considering the importance of global value chains.

On Wednesday March 24, the European Commission introduced new rules to tighten the Covid-19 vaccine export, requiring the member states to assess if the exports will pose threats on the vaccine supplies within the bloc. However, the EU leaders refused to enforce the rules considering the importance of global value chains.

![]() The trade tensions between the EU and China escalated due to the sanctions they imposed upon each other last week. The European Council announced sanctions against China over alleged human rights abuses and Beijing hit back saying it will sanction several EU citizens and entities for maliciously spreading lies and false information.

The trade tensions between the EU and China escalated due to the sanctions they imposed upon each other last week. The European Council announced sanctions against China over alleged human rights abuses and Beijing hit back saying it will sanction several EU citizens and entities for maliciously spreading lies and false information.

![]() Suez Canal navigation was suspended on Thursday March 25 after a large container vessel got stuck in the canal on Tuesday March 23. The oil prices jumped following the news due to supply disruption concerns.

Suez Canal navigation was suspended on Thursday March 25 after a large container vessel got stuck in the canal on Tuesday March 23. The oil prices jumped following the news due to supply disruption concerns.

![]() Turkish lira plunged 17% against the US dollar after the Turkish President Erdogan abruptly announced the replacement of the governor of Turkish central bank Naci Agbal. The central bank’s policymakers hiked interest rates two days before the announcement despite Erdogan called for lower rates.

Turkish lira plunged 17% against the US dollar after the Turkish President Erdogan abruptly announced the replacement of the governor of Turkish central bank Naci Agbal. The central bank’s policymakers hiked interest rates two days before the announcement despite Erdogan called for lower rates.

![]()

![]()

![]() Eurozone CPI for March will be announced on Wednesday March 31, with an expectation of 0.90% YoY.

Eurozone CPI for March will be announced on Wednesday March 31, with an expectation of 0.90% YoY.

![]() US will publish the change in Nonfarm payrolls for March on Friday April 2, which is expected at 630K.

US will publish the change in Nonfarm payrolls for March on Friday April 2, which is expected at 630K.

![]()

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 26/02/21

Notice:

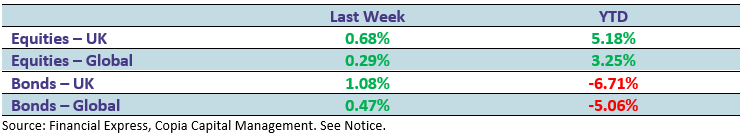

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.