![]()

![]() On Wednesday March 17, the US Fed decided to leave the federal funds rate target range unchanged at 0.00-0.25% and indicated no rate hikes through 2023 unless they see clear signs of substantial economic recovery.

On Wednesday March 17, the US Fed decided to leave the federal funds rate target range unchanged at 0.00-0.25% and indicated no rate hikes through 2023 unless they see clear signs of substantial economic recovery.

![]() Despite the dovish tone of the US Fed, the 10-year Treasury yield jumped to over 1.72% last week after the central bank adjusted up the US GDP growth forecast for 2021 to 6.5% from 4.2% and announced that it will not extend the exemption of the supplemental leverage ratio (SLR), which will expire by the end of March.

Despite the dovish tone of the US Fed, the 10-year Treasury yield jumped to over 1.72% last week after the central bank adjusted up the US GDP growth forecast for 2021 to 6.5% from 4.2% and announced that it will not extend the exemption of the supplemental leverage ratio (SLR), which will expire by the end of March.

![]() On Thursday March 18, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%, and maintaining the bond purchasing programme at £895bn. The BoE sees the economic outlook still unusually uncertain and is committed to taking further measures if needed to achieve a sustainable 2% inflation target.

On Thursday March 18, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%, and maintaining the bond purchasing programme at £895bn. The BoE sees the economic outlook still unusually uncertain and is committed to taking further measures if needed to achieve a sustainable 2% inflation target.

![]() On Friday March 19, the UK was referred to the European Union Court of Justice by the European Commission for granting illegal state aid of around €100 million as tax exemptions for Gibraltar. The EC had forced the UK to recover the aid by April 2020 while the recovery is still pending.

On Friday March 19, the UK was referred to the European Union Court of Justice by the European Commission for granting illegal state aid of around €100 million as tax exemptions for Gibraltar. The EC had forced the UK to recover the aid by April 2020 while the recovery is still pending.

![]()

![]()

![]() UK unemployment rate will be released on Tuesday March 23 and is expected at 5.1%.

UK unemployment rate will be released on Tuesday March 23 and is expected at 5.1%.

![]() UK CPI for February will be announced on Wednesday March 24, with an expectation of 0.8% YoY.

UK CPI for February will be announced on Wednesday March 24, with an expectation of 0.8% YoY.

![]()

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 26/02/21

Notice:

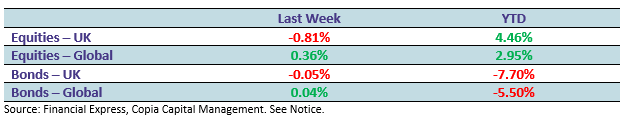

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.