![]()

![]() On Thursday March 11, the US President Joe Biden signed the $1.9 trillion coronavirus relief package called American Rescue Plan, which had the final approval by the US Congress on Wednesday March 10. Following the news, the US technology stocks rebounded sharply, pushing the Dow Jones and S&P 500 to all-time highs.

On Thursday March 11, the US President Joe Biden signed the $1.9 trillion coronavirus relief package called American Rescue Plan, which had the final approval by the US Congress on Wednesday March 10. Following the news, the US technology stocks rebounded sharply, pushing the Dow Jones and S&P 500 to all-time highs.

![]() On Thursday, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively and said will keep the pace of the bond buying programme PEPP significantly faster in the next quarter. According to the ECB President Christine Lagarde, the Eurozone GDP for 2021 is expected to grow by 4%.

On Thursday, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively and said will keep the pace of the bond buying programme PEPP significantly faster in the next quarter. According to the ECB President Christine Lagarde, the Eurozone GDP for 2021 is expected to grow by 4%.

![]() UK GDP for January 2021 was revealed on Friday March 12, showing a contraction of 2.9% compared to December 2020, and remained 9% below the pre-pandemic level. Both services and manufacturing sectors shrank in January while the construction sector expanded by 0.9%.

UK GDP for January 2021 was revealed on Friday March 12, showing a contraction of 2.9% compared to December 2020, and remained 9% below the pre-pandemic level. Both services and manufacturing sectors shrank in January while the construction sector expanded by 0.9%.

![]() Last week, Brazilian Supreme Court annulled the convictions against the country’s left-leaning former president Luiz Inacio Lula da Silva, who was sentenced on corruption charges in 2017. The former president’s political rights were restored, which means he is allowed to run for president in 2022.

Last week, Brazilian Supreme Court annulled the convictions against the country’s left-leaning former president Luiz Inacio Lula da Silva, who was sentenced on corruption charges in 2017. The former president’s political rights were restored, which means he is allowed to run for president in 2022.

![]()

![]()

![]() Eurozone CPI for February will be announced on Wednesday March 17, expected at 0.9% YoY.

Eurozone CPI for February will be announced on Wednesday March 17, expected at 0.9% YoY.

![]() BoE interest rate decision will be announced on Thursday March 18, expected to remain at 0.1%.

BoE interest rate decision will be announced on Thursday March 18, expected to remain at 0.1%.

![]()

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 26/02/21

Notice:

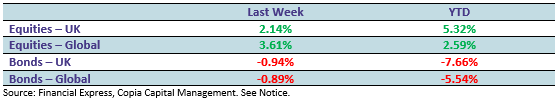

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.