![]()

![]() Last week saw another sell-off in US Treasury bonds with the ten-year Treasury yield climbing to 1.54% on Thursday March 4. The rise in Treasury yields again weighed on US tech stocks and the Nasdaq plunged to two-month low.

Last week saw another sell-off in US Treasury bonds with the ten-year Treasury yield climbing to 1.54% on Thursday March 4. The rise in Treasury yields again weighed on US tech stocks and the Nasdaq plunged to two-month low.

![]() Crude prices surged last week as OPEC+ alliance unexpectedly announced their decision to keep the current oil output cuts while the global oil market is recovering. The Saudi Energy Minister noted that the pandemic risks still remain and OPEC and OPEC+ should keep their power dry.

Crude prices surged last week as OPEC+ alliance unexpectedly announced their decision to keep the current oil output cuts while the global oil market is recovering. The Saudi Energy Minister noted that the pandemic risks still remain and OPEC and OPEC+ should keep their power dry.

![]() The UK Chancellor of the Exchequer Rishi Sunak announced on Wednesday March 3 that the UK corporation tax will be increased to 25% from 19% in 2023 and government will freeze income-tax allowances from April 2022 to 2026.

The UK Chancellor of the Exchequer Rishi Sunak announced on Wednesday March 3 that the UK corporation tax will be increased to 25% from 19% in 2023 and government will freeze income-tax allowances from April 2022 to 2026.

![]() On Friday March 5, China National People’s Congress announced a modest target for GDP growth of over 6% for 2021, setting an annual inflation target at 3% approximately and cutting the budget deficit to 3.2% of GDP for 2021.

On Friday March 5, China National People’s Congress announced a modest target for GDP growth of over 6% for 2021, setting an annual inflation target at 3% approximately and cutting the budget deficit to 3.2% of GDP for 2021.

![]()

![]()

![]() China CPI for February will be announced on Wednesday March 10, expected at -0.4% YoY.

China CPI for February will be announced on Wednesday March 10, expected at -0.4% YoY.

![]() ECB interest rate decision will be announced on Thursday March 11, expected to remain at 0.00%.

ECB interest rate decision will be announced on Thursday March 11, expected to remain at 0.00%.

![]()

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 26/02/21

Notice:

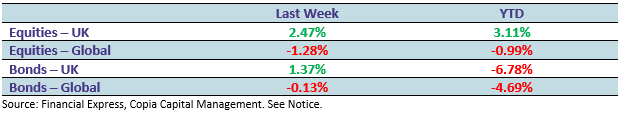

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.