![]()

![]() last week, the US Ten-year Treasury yield rose to the highest in over a year, hitting 1.61% on Thursday February 24. The US Fed Chair Jerome Powell commented that the rising long-term Treasury yield reflects the improving economic outlook and inflation expectations whereas a substantial progress in economic recovery will still take a long time.

last week, the US Ten-year Treasury yield rose to the highest in over a year, hitting 1.61% on Thursday February 24. The US Fed Chair Jerome Powell commented that the rising long-term Treasury yield reflects the improving economic outlook and inflation expectations whereas a substantial progress in economic recovery will still take a long time.

![]() The major US stock markets saw a sell-off last week due to the spike in inflation expectations, with the Dow Jones losing 1.75% and the Nasdaq 100 plunging 3.56% on Thursday. While the economic outlook is improving, investors moved away from the tech stocks which benefited during the pandemic period.

The major US stock markets saw a sell-off last week due to the spike in inflation expectations, with the Dow Jones losing 1.75% and the Nasdaq 100 plunging 3.56% on Thursday. While the economic outlook is improving, investors moved away from the tech stocks which benefited during the pandemic period.

![]() According to the data released by Office for National Statistics on Tuesday February 23, the UK unemployment rate rose to 5.1% in the three months ending in December, an increase of 0.3% from the previous quarter.

According to the data released by Office for National Statistics on Tuesday February 23, the UK unemployment rate rose to 5.1% in the three months ending in December, an increase of 0.3% from the previous quarter.

![]() The UK Covid alert level has been revised down from 5 to 4 last week. On Tuesday, Boris Johnson expressed his optimism about lifting all lockdown restrictions in England on June 21. Schools in England will reopen from March 8 and outdoor gatherings of either six people or two households will be allowed from March 29.

The UK Covid alert level has been revised down from 5 to 4 last week. On Tuesday, Boris Johnson expressed his optimism about lifting all lockdown restrictions in England on June 21. Schools in England will reopen from March 8 and outdoor gatherings of either six people or two households will be allowed from March 29.

![]()

![]()

![]() Eurozone CPI for February will be announced on Tuesday March 2, expected at 0.9% YoY.

Eurozone CPI for February will be announced on Tuesday March 2, expected at 0.9% YoY.

![]() US will publish the change in Nonfarm payrolls for February on Friday March 5, which is expected at 145K.

US will publish the change in Nonfarm payrolls for February on Friday March 5, which is expected at 145K.

![]()

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/02/21

Notice:

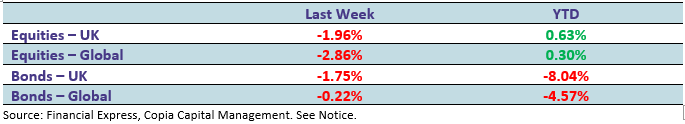

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.