![]()

![]() The US Fed Chair Jerome Powell stated on Wednesday February 10 that stimulus to aid the US economic recovery cannot be withdrawn until the country is “really through the pandemic” because the level of uncertainty caused by coronavirus pandemic is still very high.

The US Fed Chair Jerome Powell stated on Wednesday February 10 that stimulus to aid the US economic recovery cannot be withdrawn until the country is “really through the pandemic” because the level of uncertainty caused by coronavirus pandemic is still very high.

![]() US President Joe Biden had his first call with Chinese President Xi on Thursday February 11, addressing his concerns on China’s coercive and unfair economic practices, as well as abuses of human rights. China replied asking to improve dialogues between the two countries to avoid misunderstanding and promote cooperation.

US President Joe Biden had his first call with Chinese President Xi on Thursday February 11, addressing his concerns on China’s coercive and unfair economic practices, as well as abuses of human rights. China replied asking to improve dialogues between the two countries to avoid misunderstanding and promote cooperation.

![]() UK GDP for Q4 was published on Friday February 12, showing an increase of 1.0% in the three months ending in December, stronger than the forecast of 0.5% growth thanks to the more generous government spending than expected. For the entire year of 2020, UK GDP dropped 9.9%, marking the biggest annual fall in 311 years.

UK GDP for Q4 was published on Friday February 12, showing an increase of 1.0% in the three months ending in December, stronger than the forecast of 0.5% growth thanks to the more generous government spending than expected. For the entire year of 2020, UK GDP dropped 9.9%, marking the biggest annual fall in 311 years.

![]() Also on Friday, Biden suspended the legal action against TikTok and WeChat. The Biden administration will reassess if the two Chinese apps pose a national security threat claimed by Trump.

Also on Friday, Biden suspended the legal action against TikTok and WeChat. The Biden administration will reassess if the two Chinese apps pose a national security threat claimed by Trump.

![]()

![]()

![]() UK CPI for January will be announced on Wednesday February 17, expected at 0.5% YoY.

UK CPI for January will be announced on Wednesday February 17, expected at 0.5% YoY.

![]() On Friday February 19, Eurozone Markit Composite PMI will be released and is expected to come in at 48.0.

On Friday February 19, Eurozone Markit Composite PMI will be released and is expected to come in at 48.0.

![]()

+0.70*

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/02/21

Notice:

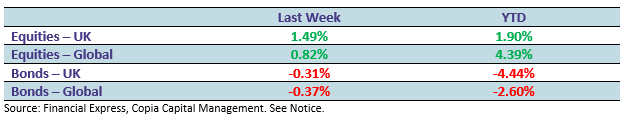

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.