![]()

![]() Former President of the ECB Mario Draghi accepted on Wednesday February 3 to form a new government in Italy, which would still require parliamentary support. Draghi was invited by Italy’s President Sergio Mattarella after the resignation of the country’s Prime Minister Giuseppe Conte.

Former President of the ECB Mario Draghi accepted on Wednesday February 3 to form a new government in Italy, which would still require parliamentary support. Draghi was invited by Italy’s President Sergio Mattarella after the resignation of the country’s Prime Minister Giuseppe Conte.

![]() On Thursday February 4, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%, warning that the economic outlook is still uncertain as the coronavirus spread is not fully under control despite the vaccine rollout. The bank will continue to purchase corporate bond at £20bn with the total value of the bond purchasing programme maintained at £895bn.

On Thursday February 4, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%, warning that the economic outlook is still uncertain as the coronavirus spread is not fully under control despite the vaccine rollout. The bank will continue to purchase corporate bond at £20bn with the total value of the bond purchasing programme maintained at £895bn.

![]() On Friday February 5, Robinhood lifted the buying restrictions on all of its stocks, including GameStop and AMC Entertainment. The restrictions were initially placed because groups of retail investors had targeted and driven up prices of these shares significantly.

On Friday February 5, Robinhood lifted the buying restrictions on all of its stocks, including GameStop and AMC Entertainment. The restrictions were initially placed because groups of retail investors had targeted and driven up prices of these shares significantly.

![]() Last week, brent crude and WTI prices rose to the highest levels since the start of pandemic following the OPEC+ announcement of their agreement on supply cut among the member states.

Last week, brent crude and WTI prices rose to the highest levels since the start of pandemic following the OPEC+ announcement of their agreement on supply cut among the member states.

![]()

![]()

![]() China CPI for January will be announced on Wednesday February 10, with an expectation of -0.1% YoY.

China CPI for January will be announced on Wednesday February 10, with an expectation of -0.1% YoY.

![]() US CPI for January will be announced on the same day, Wednesday February 10, expected at 1.5% YoY.

US CPI for January will be announced on the same day, Wednesday February 10, expected at 1.5% YoY.

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/02/21

Notice:

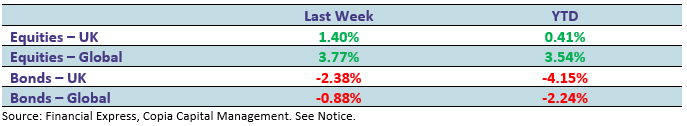

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.