![]()

![]() On Wednesday January 13, the US House of Representatives voted in favour of impeaching President Donald Trump for the second time, accusing him of inciting a riot at US Capitol last week.

On Wednesday January 13, the US House of Representatives voted in favour of impeaching President Donald Trump for the second time, accusing him of inciting a riot at US Capitol last week.

![]() On Thursday January 14, Joe Biden revealed a coronavirus stimulus proposal worth $1.9tn, which includes raises on one-time payment, federal minimum wage, unemployment benefits as well as financial aids to state and local governments, schools and hospitals for Covid testing and vaccine distribution.

On Thursday January 14, Joe Biden revealed a coronavirus stimulus proposal worth $1.9tn, which includes raises on one-time payment, federal minimum wage, unemployment benefits as well as financial aids to state and local governments, schools and hospitals for Covid testing and vaccine distribution.

![]() The US initial jobless claims published on Thursday showed an unexpected surge of 181k to 965k people filing for unemployment benefits in the week ending January 9, the highest since August 2020.

The US initial jobless claims published on Thursday showed an unexpected surge of 181k to 965k people filing for unemployment benefits in the week ending January 9, the highest since August 2020.

![]() Dutch government resigned on Friday January 15 over the scandal of mismanaging childcare subsidies for around 10 years. Parliamentary elections are scheduled on March 17 and the current government will stay in position until then.

Dutch government resigned on Friday January 15 over the scandal of mismanaging childcare subsidies for around 10 years. Parliamentary elections are scheduled on March 17 and the current government will stay in position until then.

![]()

![]()

![]() China GDP growth will be released on Monday January 18, at an expected rate of 6.2% YoY.

China GDP growth will be released on Monday January 18, at an expected rate of 6.2% YoY.

![]() UK CPI for December will be announced on Wednesday January 20, with an expectation of 0.5% YoY.

UK CPI for December will be announced on Wednesday January 20, with an expectation of 0.5% YoY.

![]()

+0.49*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/12/20

Notice:

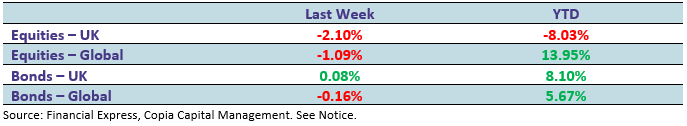

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.