![]()

![]() Bitcoin slumped briefly below $10,000 on regulatory fears marking a fall close to 50% from its highs set last year.

Bitcoin slumped briefly below $10,000 on regulatory fears marking a fall close to 50% from its highs set last year.

![]() US Dollar weakness persists as the Dollar continues its 2017 losing streak on fears the new US Tax Reform will cause the US budget deficit to widen and increase inflation.

US Dollar weakness persists as the Dollar continues its 2017 losing streak on fears the new US Tax Reform will cause the US budget deficit to widen and increase inflation.

![]() At the Anglo-French summit, French President Emmanuel Macron stated that if the UK banking sector wanted to be part of the single market then the UK will need to accept EU jurisdiction and continue to make financial contributions.

At the Anglo-French summit, French President Emmanuel Macron stated that if the UK banking sector wanted to be part of the single market then the UK will need to accept EU jurisdiction and continue to make financial contributions.

![]() The US government faced a shutdown as the Republicans attempt to pass a funding proposal through the Senate.

The US government faced a shutdown as the Republicans attempt to pass a funding proposal through the Senate.

![]()

![]()

![]() ECB will announce its rate decision on 25th January, with interest rate expected to be at 0%.

ECB will announce its rate decision on 25th January, with interest rate expected to be at 0%.

![]() On Friday, January 26th, US and UK GDP data is expected to come in at 2.9% and 1.4% YoY growth respectively.

On Friday, January 26th, US and UK GDP data is expected to come in at 2.9% and 1.4% YoY growth respectively.

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/01/18

Notice:

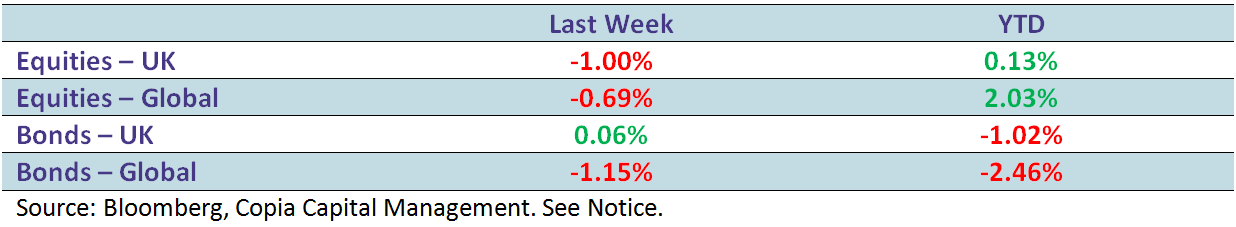

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.