![]()

![]() Last week saw the strong momentum of Bitcoin price, which continued to surge, surpassing $41,000 on Friday January 8, reaching its all-time high.

Last week saw the strong momentum of Bitcoin price, which continued to surge, surpassing $41,000 on Friday January 8, reaching its all-time high.

![]() On Tuesday January 5, the US Senate runoff election was taken for Georgia, with Democrats winning both seats. This means that Democrats now have the control of the Senate, the House of Representatives and the White House.

On Tuesday January 5, the US Senate runoff election was taken for Georgia, with Democrats winning both seats. This means that Democrats now have the control of the Senate, the House of Representatives and the White House.

![]() On Thursday January 7, Tesla stock price rose 7.94% to $816.04, making the founder of the company Elon Musk the richest person in the world, with a net worth of more than $185 billion.

On Thursday January 7, Tesla stock price rose 7.94% to $816.04, making the founder of the company Elon Musk the richest person in the world, with a net worth of more than $185 billion.

![]() Also on Thursday, the US Congress confirmed Joe Biden as the country’s next president. On the same day, the US Capitol was stormed by violent rioters supporting Trump.

Also on Thursday, the US Congress confirmed Joe Biden as the country’s next president. On the same day, the US Capitol was stormed by violent rioters supporting Trump.

![]()

![]()

![]() China CPI for December will be announced on Monday January 11, with an expectation of 0.0% YoY.

China CPI for December will be announced on Monday January 11, with an expectation of 0.0% YoY.

![]() US CPI for December will be announced on Wednesday January 13, with an expectation of 1.3% YoY.

US CPI for December will be announced on Wednesday January 13, with an expectation of 1.3% YoY.

![]()

+0.49*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/12/20

Notice:

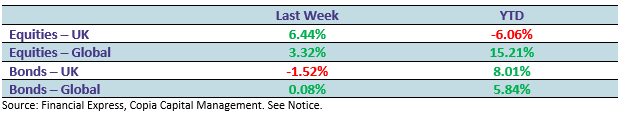

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.