![]()

![]() On Wednesday December 16, the US Fed decided to leave the federal funds rate target range unchanged at 0.00-0.25%. The central bank adjusted the QE forward guidance, confirming that it will continue the current monthly bond purchase at $120bn “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.”

On Wednesday December 16, the US Fed decided to leave the federal funds rate target range unchanged at 0.00-0.25%. The central bank adjusted the QE forward guidance, confirming that it will continue the current monthly bond purchase at $120bn “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.”

![]() On Thursday December 17, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%. The bank left the corporate bond purchasing programme at £895bn, after a lift of £150bn last month.

On Thursday December 17, the BoE made interest rates decision to keep the benchmark Bank Rate unchanged at 0.1%. The bank left the corporate bond purchasing programme at £895bn, after a lift of £150bn last month.

![]() Also on Thursday, UK Chancellor Rishi Sunak announced a further 1-month extension on government’s furlough scheme, which will now expire by the end of April 2021. According to the data released by Office for National Statistics on Tuesday December 15, the UK unemployment rate rose to 4.9% in the three months ending in October, the highest since 2016.

Also on Thursday, UK Chancellor Rishi Sunak announced a further 1-month extension on government’s furlough scheme, which will now expire by the end of April 2021. According to the data released by Office for National Statistics on Tuesday December 15, the UK unemployment rate rose to 4.9% in the three months ending in October, the highest since 2016.

![]() The Elysee Palace announced on Thursday that French President Emmanuel Macron has been tested positive for coronavirus and has started 7-day isolation at home.

The Elysee Palace announced on Thursday that French President Emmanuel Macron has been tested positive for coronavirus and has started 7-day isolation at home.

![]()

![]()

![]() People’s Bank of China will announce interest rates decision on Monday December 21, and is expected to leave it unchanged at 3.85%.

People’s Bank of China will announce interest rates decision on Monday December 21, and is expected to leave it unchanged at 3.85%.

![]() The UK GDP growth (final revision) for Q3 2020 will be released on Tuesday December 22, at an expected rate of -9.6% YoY.

The UK GDP growth (final revision) for Q3 2020 will be released on Tuesday December 22, at an expected rate of -9.6% YoY.

![]()

+0.05*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/20

Notice:

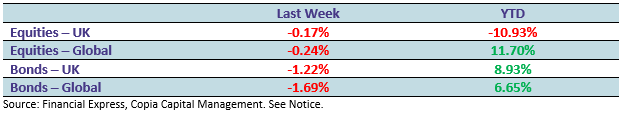

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.