![]()

![]() China’s CPI for November was released on Wednesday December 9, coming in worse than expected with a fall of 0.5% YoY, marking the first CPI contraction since 2009.

China’s CPI for November was released on Wednesday December 9, coming in worse than expected with a fall of 0.5% YoY, marking the first CPI contraction since 2009.

![]() On Thursday December 10, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively. The bank, as expected, increased the pandemic emergency purchase program (PEPP) by €500bn to a total of €1.85tr to improve the financing conditions in the economy.

On Thursday December 10, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively. The bank, as expected, increased the pandemic emergency purchase program (PEPP) by €500bn to a total of €1.85tr to improve the financing conditions in the economy.

![]() On Thursday, the European Union reached an agreement on the bloc’s budget plan with the member states Hungary and Poland, which initially opposed the proposal. This includes €1.8tr budget and €750bn fiscal package.

On Thursday, the European Union reached an agreement on the bloc’s budget plan with the member states Hungary and Poland, which initially opposed the proposal. This includes €1.8tr budget and €750bn fiscal package.

![]() Boris Johnson said on Thursday that there is a strong possibility of a no-deal Brexit despite the UK has been incredibly flexible in talks with the EU. He warned that the country should be prepared for an Australian-style deal with the EU.

Boris Johnson said on Thursday that there is a strong possibility of a no-deal Brexit despite the UK has been incredibly flexible in talks with the EU. He warned that the country should be prepared for an Australian-style deal with the EU.

![]()

![]()

![]() UK CPI for November will be announced on Wednesday December 16, with an expectation of 0.6% YoY.

UK CPI for November will be announced on Wednesday December 16, with an expectation of 0.6% YoY.

![]() The US Markit Manufacturing PMI will be revealed on the same day, Wednesday December 16, and is expected to come in at 56.0.

The US Markit Manufacturing PMI will be revealed on the same day, Wednesday December 16, and is expected to come in at 56.0.

![]()

+0.05*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/11/20

Notice:

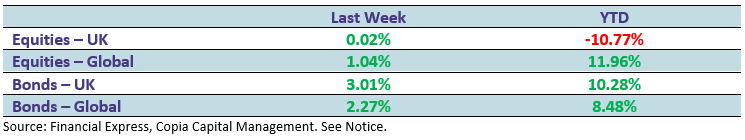

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.