![]()

![]() Pfizer and BioNTech announced their vaccine result on Monday November 9, which is claimed to have more than 90% effectiveness in a study of 44,000 people. The companies have agreed to supply 40 million doses to the UK and 200 million to the EU.

Pfizer and BioNTech announced their vaccine result on Monday November 9, which is claimed to have more than 90% effectiveness in a study of 44,000 people. The companies have agreed to supply 40 million doses to the UK and 200 million to the EU.

![]() Boris Johnson’s communications director, Lee Cain announced his resignation on Wednesday November 10 and will leave his position at the end of this year. According to BBC News on Friday November 13, Johnson’s senior adviser, Dominic Cummings is also expected to leave the government before the end of the year.

Boris Johnson’s communications director, Lee Cain announced his resignation on Wednesday November 10 and will leave his position at the end of this year. According to BBC News on Friday November 13, Johnson’s senior adviser, Dominic Cummings is also expected to leave the government before the end of the year.

![]() The UK GDP figure revealed on Thursday shows that for the three months ending in September, the UK GDP has grown by 15.5%, which is in line with the expectations but remains 8.2% lower than the pre-pandemic level.

The UK GDP figure revealed on Thursday shows that for the three months ending in September, the UK GDP has grown by 15.5%, which is in line with the expectations but remains 8.2% lower than the pre-pandemic level.

![]() On Thursday November 12, Trump signed an executive order that bans the US firms to invest in companies that are resourcing Chinese military, noting that these companies are supporting China military using the capital raised from American investors.

On Thursday November 12, Trump signed an executive order that bans the US firms to invest in companies that are resourcing Chinese military, noting that these companies are supporting China military using the capital raised from American investors.

![]()

![]()

![]() Japan annualised GDP growth will be released on Sunday November 15, at an expected rate of 18.9% QoQ.

Japan annualised GDP growth will be released on Sunday November 15, at an expected rate of 18.9% QoQ.

![]() UK CPI for October will be announced on Wednesday November 18, with an expectation of 0.5% YoY.

UK CPI for October will be announced on Wednesday November 18, with an expectation of 0.5% YoY.

![]()

-0.07*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/10/20

Notice:

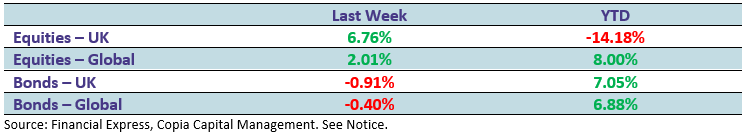

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.