![]()

![]() On Thursday October 22, UK signed a trade deal with Japan, which aims to boost the trade between two nations by £15bn over 15 years. Similar to the existing EU’s pact, the trade deal allows 99% of UK exports to Japan to be tariff-free.

On Thursday October 22, UK signed a trade deal with Japan, which aims to boost the trade between two nations by £15bn over 15 years. Similar to the existing EU’s pact, the trade deal allows 99% of UK exports to Japan to be tariff-free.

![]() On Thursday, UK Chancellor Rishi Sunak announced revisions to the new Job Support Scheme, which will subsidise 62% instead of previous 33% of the wages for hours that an employee is not working due to Covid. Meanwhile, the minimum working hour for an employee to claim the subsidy will be reduced from 33% to 20%.

On Thursday, UK Chancellor Rishi Sunak announced revisions to the new Job Support Scheme, which will subsidise 62% instead of previous 33% of the wages for hours that an employee is not working due to Covid. Meanwhile, the minimum working hour for an employee to claim the subsidy will be reduced from 33% to 20%.

![]() On Thursday, Gilead Sciences announced that Veklury, a treatment of the coronavirus infections, received approval from the US Food and Drug Administration (FDA), which is the first coronavirus treatment approved by the US.

On Thursday, Gilead Sciences announced that Veklury, a treatment of the coronavirus infections, received approval from the US Food and Drug Administration (FDA), which is the first coronavirus treatment approved by the US.

![]() Joe Biden and Donald Trump had their second and final presidential debate on Thursday. The debate mainly focused on key issues including the US coronavirus pandemic, economy recovery and climate change. According to a CNN poll, Joe Biden was perceived as the winner of the debate.

Joe Biden and Donald Trump had their second and final presidential debate on Thursday. The debate mainly focused on key issues including the US coronavirus pandemic, economy recovery and climate change. According to a CNN poll, Joe Biden was perceived as the winner of the debate.

![]()

![]()

![]() Germany IFO Business Climate index will be published on the Monday October 26, expected at 93.0.

Germany IFO Business Climate index will be published on the Monday October 26, expected at 93.0.

![]() Eurozone CPI for October will be announced on Friday October 30, with an expectation of -0.3% YoY.

Eurozone CPI for October will be announced on Friday October 30, with an expectation of -0.3% YoY.

![]()

-0.11*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 17/10/20

Notice:

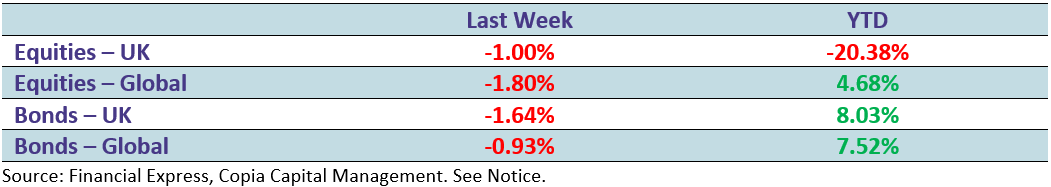

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.