![]()

![]() Europe saw surging new Covid cases last week with the UK, Germany, France and Spain reporting acceleration in infections. On Thursday October 9, Boris Johnson ordered pubs and restaurants in northern England to shut. The Spanish government approved a partial lockdown in Madrid on Friday October 9.

Europe saw surging new Covid cases last week with the UK, Germany, France and Spain reporting acceleration in infections. On Thursday October 9, Boris Johnson ordered pubs and restaurants in northern England to shut. The Spanish government approved a partial lockdown in Madrid on Friday October 9.

![]() UK Chancellor of Exchequer Rishi Sunak announced on Friday a new local furlough scheme to aid the businesses that shut down because of the lockdown restrictions. The plan includes paying two-thirds of the wages to the employees affected as well as increasing the cash grants to the businesses.

UK Chancellor of Exchequer Rishi Sunak announced on Friday a new local furlough scheme to aid the businesses that shut down because of the lockdown restrictions. The plan includes paying two-thirds of the wages to the employees affected as well as increasing the cash grants to the businesses.

![]() Eurozone inflation rate for September was published, standing at -0.3% YoY, sliding further down in the negative territory compared to -0.2% YoY in August. The inflation of Germany, France, Italy and Spain, the four largest economies in Eurozone all came in below the market expectations in September.

Eurozone inflation rate for September was published, standing at -0.3% YoY, sliding further down in the negative territory compared to -0.2% YoY in August. The inflation of Germany, France, Italy and Spain, the four largest economies in Eurozone all came in below the market expectations in September.

![]() China Caixin Service PMI was published on Friday October 9, standing at 54.8, beating the market estimates and showing a continuous expansion of the service sector.

China Caixin Service PMI was published on Friday October 9, standing at 54.8, beating the market estimates and showing a continuous expansion of the service sector.

![]()

![]()

![]() UK unemployment rate will be released on Tuesday October 13 and is expected at 4.1%.

UK unemployment rate will be released on Tuesday October 13 and is expected at 4.1%.

![]() China CPI for September will be announced on Thursday October 15, with an expectation of 1.9% YoY.

China CPI for September will be announced on Thursday October 15, with an expectation of 1.9% YoY.

![]()

-0.19*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/20

Notice:

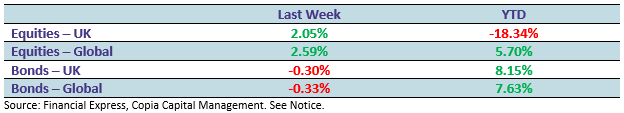

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.