![]()

![]() On Thursday October 1, European Commission President Ursula von der Leyen announced that the EU has started legal proceedings against the UK over the Internal Market Bill which violates the Brexit Withdrawal Agreement and international law.

On Thursday October 1, European Commission President Ursula von der Leyen announced that the EU has started legal proceedings against the UK over the Internal Market Bill which violates the Brexit Withdrawal Agreement and international law.

![]() On Friday October 2, the US President Donald Trump revealed on Twitter that he and his wife Melania have been tested positive for coronavirus and will begin the quarantine process. Trump and Joe Biden had the first presidential debate on Tuesday September 29 and Biden is expected to get tested for coronavirus.

On Friday October 2, the US President Donald Trump revealed on Twitter that he and his wife Melania have been tested positive for coronavirus and will begin the quarantine process. Trump and Joe Biden had the first presidential debate on Tuesday September 29 and Biden is expected to get tested for coronavirus.

![]() China Manufacturing PMI for September was released on Wednesday September 30, coming in at 51.5, beating the market expectation of 51.3 and signalling a steady expansion of the manufacturing sector in China.

China Manufacturing PMI for September was released on Wednesday September 30, coming in at 51.5, beating the market expectation of 51.3 and signalling a steady expansion of the manufacturing sector in China.

![]() On Friday October 2, US nonfarm payrolls data was published, showing an employment increase of 661K in September, lower than the estimates of 859K while the unemployment rate dropped by 0.5% to 7.9%, standing at the lowest level since February.

On Friday October 2, US nonfarm payrolls data was published, showing an employment increase of 661K in September, lower than the estimates of 859K while the unemployment rate dropped by 0.5% to 7.9%, standing at the lowest level since February.

![]()

![]()

![]() Eurozone retail sales for August will be published on Monday October 5, expected at 2.2%.

Eurozone retail sales for August will be published on Monday October 5, expected at 2.2%.

![]() Canada unemployment rate will be released on Friday October 9, expected at 10.1%.

Canada unemployment rate will be released on Friday October 9, expected at 10.1%.

![]()

-0.19*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/20

Notice:

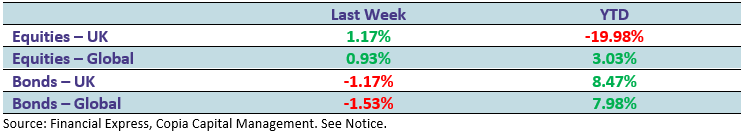

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.