![]()

![]() Last week saw a new surge in coronavirus cases in Europe with the UK, Spain, France and Russia all reporting steady increase in daily cases. The US had over 7 million confirmed cases, remaining the most affected country, followed by India and Brazil, which recorded more than 5.7 million and 4.6 million cases respectively.

Last week saw a new surge in coronavirus cases in Europe with the UK, Spain, France and Russia all reporting steady increase in daily cases. The US had over 7 million confirmed cases, remaining the most affected country, followed by India and Brazil, which recorded more than 5.7 million and 4.6 million cases respectively.

![]() On Wednesday September 23, Eurozone Composite PMI for September was published, dropping to 50.1 from 51.9 in August. The Services PMI fell below 50 to 47.6 whereas, the Manufacturing PMI improved to a two-year high at 53.7.

On Wednesday September 23, Eurozone Composite PMI for September was published, dropping to 50.1 from 51.9 in August. The Services PMI fell below 50 to 47.6 whereas, the Manufacturing PMI improved to a two-year high at 53.7.

![]() On Thursday September 24, the UK announced that it will extend the coronavirus containment measures and provide a new job support scheme when the current furlough scheme ends, for at least six months. On the same day, BoE Governor Bailey said that the bank could move to negative interest rates if necessary and commented that the economic recovery may not follow the fast pattern over the summer.

On Thursday September 24, the UK announced that it will extend the coronavirus containment measures and provide a new job support scheme when the current furlough scheme ends, for at least six months. On the same day, BoE Governor Bailey said that the bank could move to negative interest rates if necessary and commented that the economic recovery may not follow the fast pattern over the summer.

![]() On Friday September 25, an official from the China National Health Commission said that the annual production of coronavirus vaccine is expected to reach 610 million doses by the end of this year in China.

On Friday September 25, an official from the China National Health Commission said that the annual production of coronavirus vaccine is expected to reach 610 million doses by the end of this year in China.

![]()

![]()

![]() On Wednesday September 30, China Caixin Manufacturing PMI will be released and is expected to come in at 53.1.

On Wednesday September 30, China Caixin Manufacturing PMI will be released and is expected to come in at 53.1.

![]() US will publish the change in Nonfarm payrolls for September on Friday October 2, which is expected at 900K.

US will publish the change in Nonfarm payrolls for September on Friday October 2, which is expected at 900K.

![]()

-0.44*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 18/09/20

Notice:

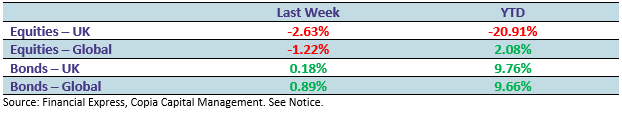

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.