![]()

![]() On Wednesday July 29, the US Fed decided to keep the target range for the federal funds rate unchanged at 0.00-0.25% and warned about the sharp declines in economic activities as well as the surge in job losses due to the current pandemic. The latest US initial jobless claims figure showed a continuous increase of 12,000 for the week ending July 25.

On Wednesday July 29, the US Fed decided to keep the target range for the federal funds rate unchanged at 0.00-0.25% and warned about the sharp declines in economic activities as well as the surge in job losses due to the current pandemic. The latest US initial jobless claims figure showed a continuous increase of 12,000 for the week ending July 25.

![]() On Thursday July 30, Alphabet, Amazon, Apple and Facebook released quarterly earnings reports. Alphabet reported its revenue falling 2% YoY to $38.29 billion in Q2 2020, though still beating estimates of $37.36 billion. The company’s earnings per share (EPS) fell to $6.49 from $11.63 a year ago. Apple’s quarterly revenue rose by 11%, landing at $59.68 billion and EPS increased 18% YoY to $2.58, both topping expectations. Amazon reported a strong growth in revenue and EPS, with revenue increasing 40% YoY to $88.9 billion and EPS jumping 24% to $10.3. Facebook’s revenue went up 11% to $18.7 billion while EPS were down 23% to $1.8.

On Thursday July 30, Alphabet, Amazon, Apple and Facebook released quarterly earnings reports. Alphabet reported its revenue falling 2% YoY to $38.29 billion in Q2 2020, though still beating estimates of $37.36 billion. The company’s earnings per share (EPS) fell to $6.49 from $11.63 a year ago. Apple’s quarterly revenue rose by 11%, landing at $59.68 billion and EPS increased 18% YoY to $2.58, both topping expectations. Amazon reported a strong growth in revenue and EPS, with revenue increasing 40% YoY to $88.9 billion and EPS jumping 24% to $10.3. Facebook’s revenue went up 11% to $18.7 billion while EPS were down 23% to $1.8.

![]() On Friday July 31, the US reported an increase of 72,238 Covid-19 infections in 24 hours, bringing the total infections in the US to 4,487,072 since the start of pandemic. On the same day, the number of coronavirus cases in India and Brazil rose by a record 55,078 and 57,837 respectively. The fears of a second wave of coronavirus kept rising.

On Friday July 31, the US reported an increase of 72,238 Covid-19 infections in 24 hours, bringing the total infections in the US to 4,487,072 since the start of pandemic. On the same day, the number of coronavirus cases in India and Brazil rose by a record 55,078 and 57,837 respectively. The fears of a second wave of coronavirus kept rising.

![]() US GDP was released on Thursday, showing a decline of 32.9% in the second quarter and a drop of 9.5% on a yearly basis, marking the worst quarter since the second world war whereas it was better than the expected contraction of 34.1%. Eurozone GDP plunged 12.1% in Q2, in line with the market expectation and the GDP slid 15% compared to Q2 last year according to the data published on Friday.

US GDP was released on Thursday, showing a decline of 32.9% in the second quarter and a drop of 9.5% on a yearly basis, marking the worst quarter since the second world war whereas it was better than the expected contraction of 34.1%. Eurozone GDP plunged 12.1% in Q2, in line with the market expectation and the GDP slid 15% compared to Q2 last year according to the data published on Friday.

![]()

![]()

![]() BoE will make interest rate decision on Thursday August 6 and is expected to keep the base rate at 0.10%.

BoE will make interest rate decision on Thursday August 6 and is expected to keep the base rate at 0.10%.

![]() US Non-farm payroll employment data will be released on Friday August 7, with an expectation of 1,635,000 new jobs created for the month of July.

US Non-farm payroll employment data will be released on Friday August 7, with an expectation of 1,635,000 new jobs created for the month of July.

![]()

-0.47*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/20

Notice:

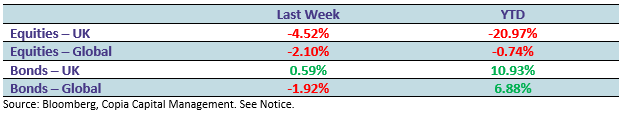

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.