![]()

![]() On Tuesday July 7, Trump administration announced that the US has started the World Health Organization (WHO) withdrawal process and planned to officially leave WHO on July 6 2021. On Wednesday July 8, the US registered 63,000 new Covid-19 infections in a single day, with the total infection number exceeding 3 million.

On Tuesday July 7, Trump administration announced that the US has started the World Health Organization (WHO) withdrawal process and planned to officially leave WHO on July 6 2021. On Wednesday July 8, the US registered 63,000 new Covid-19 infections in a single day, with the total infection number exceeding 3 million.

![]() Gold prices rose above $1,800 per ounce on Wednesday for the first time since September 2011 due to falling real rates and Covid-19 fears.

Gold prices rose above $1,800 per ounce on Wednesday for the first time since September 2011 due to falling real rates and Covid-19 fears.

![]() UK Chancellor of Exchequer Rishi Sunak announced new measures worth £30 billion on Wednesday mainly to protect jobs affected by Covid-19. The new stimulus includes bonuses for companies retaining furloughed workers and employing young workers, stamp duty tax cut, value-added tax cut for hospitality sector and energy saving grants to homeowners.

UK Chancellor of Exchequer Rishi Sunak announced new measures worth £30 billion on Wednesday mainly to protect jobs affected by Covid-19. The new stimulus includes bonuses for companies retaining furloughed workers and employing young workers, stamp duty tax cut, value-added tax cut for hospitality sector and energy saving grants to homeowners.

![]() Google announced on Thursday that it will help Italy economy recover from coronavirus outbreak by investing over $900 million in the next five years to help small and medium sized businesses. On the same day, the European Commission approved Italy’s grants scheme worth €6.2 billion that is also aimed to support small businesses and the self-employed affected by the Covid-19 pandemic.

Google announced on Thursday that it will help Italy economy recover from coronavirus outbreak by investing over $900 million in the next five years to help small and medium sized businesses. On the same day, the European Commission approved Italy’s grants scheme worth €6.2 billion that is also aimed to support small businesses and the self-employed affected by the Covid-19 pandemic.

![]()

![]()

![]() UK CPI will be announced on Wednesday July 15, with an expectation of 0.50% YoY.

UK CPI will be announced on Wednesday July 15, with an expectation of 0.50% YoY.

![]() UK unemployment rate will be released on Thursday July 16, expected at 4.70%.

UK unemployment rate will be released on Thursday July 16, expected at 4.70%.

![]()

-0.50*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/06/20

Notice:

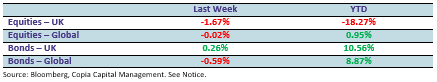

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.