![]()

![]() On Tuesday June 30, Chinese President Xi Jinping signed the new national security law for Hong Kong. The new legislation has been controversial with critics claiming that it will violate Hong Kong’s freedom. Boris Johnson responded on July 1 that UK will offer up to 3 million Hong Kong citizens the chance to move to the UK. On July 3, the US Senate passed a bill that will penalise banks doing business with Chinese officials, showing their concerns about the new Hong Kong law.

On Tuesday June 30, Chinese President Xi Jinping signed the new national security law for Hong Kong. The new legislation has been controversial with critics claiming that it will violate Hong Kong’s freedom. Boris Johnson responded on July 1 that UK will offer up to 3 million Hong Kong citizens the chance to move to the UK. On July 3, the US Senate passed a bill that will penalise banks doing business with Chinese officials, showing their concerns about the new Hong Kong law.

![]() Prime Minister of France Edouard Philippe resigned on Friday July 3. On the same day, Jean Castex, who was active in handling the reopening of the economy from the pandemic lockdown, was appointed as the new Prime Minister to form a new government. The reshuffled government will focus on the economic recovery from the Covid-19 shock.

Prime Minister of France Edouard Philippe resigned on Friday July 3. On the same day, Jean Castex, who was active in handling the reopening of the economy from the pandemic lockdown, was appointed as the new Prime Minister to form a new government. The reshuffled government will focus on the economic recovery from the Covid-19 shock.

![]() On Thursday July 2, US nonfarm payrolls data was published, showing an employment increase of 4.8 million in June, significantly higher than the estimates of 2.9 million. The US unemployment rate decreased by 2.2%, standing at 11.1%.

On Thursday July 2, US nonfarm payrolls data was published, showing an employment increase of 4.8 million in June, significantly higher than the estimates of 2.9 million. The US unemployment rate decreased by 2.2%, standing at 11.1%.

![]() China Caixin Services PMI for June hit the highest level over a decade, recorded at 58.4, beating the market expectation of 53.2. The jump in business activities reflects the surge in demand after the easing of lockdown restrictions in China.

China Caixin Services PMI for June hit the highest level over a decade, recorded at 58.4, beating the market expectation of 53.2. The jump in business activities reflects the surge in demand after the easing of lockdown restrictions in China.

![]()

![]()

![]() Eurozone retail sales for May will be published on Monday July 6, expected at -7.5%.

Eurozone retail sales for May will be published on Monday July 6, expected at -7.5%.

![]() China CPI will be announced on Thursday July 9, with an expectation of 2.70% YoY.

China CPI will be announced on Thursday July 9, with an expectation of 2.70% YoY.

![]()

-0.50*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/06/20

Notice:

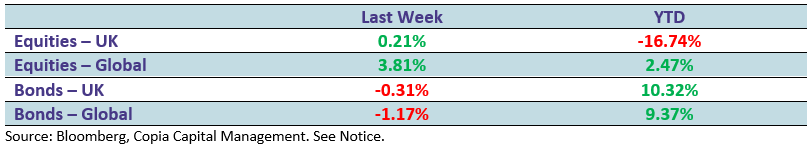

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.