![]()

![]() Beijing saw the resurgence of the coronavirus infections over last week, reporting 49 new cases on Monday June 15. The Beijing government imposed a lockdown on all residential communities to contain the virus spreading.

Beijing saw the resurgence of the coronavirus infections over last week, reporting 49 new cases on Monday June 15. The Beijing government imposed a lockdown on all residential communities to contain the virus spreading.

![]() On Thursday June 19, BoE decided to keep its benchmark rate unchanged at 0.1% and to increase its bond-buying programme by £100bn, taking the total value of bond purchase to £745bn. The Bank however said will slow the pace of bond-buying and is expected to complete it by the end of the year.

On Thursday June 19, BoE decided to keep its benchmark rate unchanged at 0.1% and to increase its bond-buying programme by £100bn, taking the total value of bond purchase to £745bn. The Bank however said will slow the pace of bond-buying and is expected to complete it by the end of the year.

![]() The US Fed announced that it will start buying corporate bonds from Tuesday June 16 as part of its $250bn emergency lending programme – secondary market corporate credit facility (SMCCF), which so far has only invested corporate bond ETFs since established in March 2020.

The US Fed announced that it will start buying corporate bonds from Tuesday June 16 as part of its $250bn emergency lending programme – secondary market corporate credit facility (SMCCF), which so far has only invested corporate bond ETFs since established in March 2020.

![]() UK retail sales rebounded in May, surging 12% from the record low in April, contributed most by the rising household goods sales, online sales, and fuel sales after the relaxed lockdown restrictions.

UK retail sales rebounded in May, surging 12% from the record low in April, contributed most by the rising household goods sales, online sales, and fuel sales after the relaxed lockdown restrictions.

![]()

![]()

![]() On Tuesday June 23, Eurozone Manufacturing PMI will be released and is expected to come in at 43.8.

On Tuesday June 23, Eurozone Manufacturing PMI will be released and is expected to come in at 43.8.

![]() Germany IFO Business Climate index will be published on the Wednesday June 24, expected at 85.0.

Germany IFO Business Climate index will be published on the Wednesday June 24, expected at 85.0.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/2020

Notice:

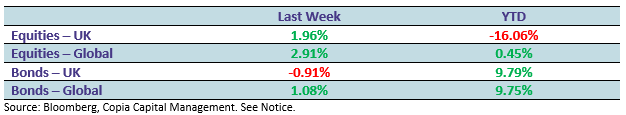

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.