![]()

![]() The US-China tensions intensified over last week. China passed the new National Security Law for Hong Kong on Thursday May 28 despite US President Trump’s threats to take very powerful actions against the new Hong Kong law. China responded saying the matter was an internal affair and called for the US and its allies to stop interfering.

The US-China tensions intensified over last week. China passed the new National Security Law for Hong Kong on Thursday May 28 despite US President Trump’s threats to take very powerful actions against the new Hong Kong law. China responded saying the matter was an internal affair and called for the US and its allies to stop interfering.

![]() On Wednesday, the European Commission proposed a €750 billion recovery fund plan of which €500 billion would be distributed as grants to member states and €250 billion would be offered as loans. Italy and Spain, which were impacted the most by Covid-19 pandemic will receive the highest level of the grants.

On Wednesday, the European Commission proposed a €750 billion recovery fund plan of which €500 billion would be distributed as grants to member states and €250 billion would be offered as loans. Italy and Spain, which were impacted the most by Covid-19 pandemic will receive the highest level of the grants.

![]() The Japanese government approved the second stimulus package worth $1.1 trillion on Wednesday May 27. The package will be funded by the issuance of government bonds. Together with the previous stimulus package, Japan will spend $2.18 trillion or 40% of the country’s GDP to help its economic recovery.

The Japanese government approved the second stimulus package worth $1.1 trillion on Wednesday May 27. The package will be funded by the issuance of government bonds. Together with the previous stimulus package, Japan will spend $2.18 trillion or 40% of the country’s GDP to help its economic recovery.

![]() The US initial jobless claims published on Thursday showed another 2.1 million people filed for unemployment benefits in the week ending May 23. The total number of jobless people in the US reached a new historical level of more than 40 million since the start of the pandemic.

The US initial jobless claims published on Thursday showed another 2.1 million people filed for unemployment benefits in the week ending May 23. The total number of jobless people in the US reached a new historical level of more than 40 million since the start of the pandemic.

![]()

![]()

![]() On Monday June 1, China Manufacturing PMI will be released and is expected to come in at 49.6.

On Monday June 1, China Manufacturing PMI will be released and is expected to come in at 49.6.

![]() US unemployment rate will be released on Friday June 5, expected at 19.8%.

US unemployment rate will be released on Friday June 5, expected at 19.8%.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/2020

Notice:

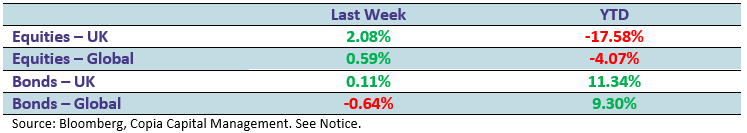

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.