![]()

![]() On Monday May 18, Angela Merkel and Emmanuel Macron proposed a €500 billion recovery fund plan for European economies to cope with coronavirus. The fund would be taken from the EU which borrows money from financial markets via issuing debts and distributed to countries and businesses impacted by coronavirus as grants instead of loans. And the debts would not be expected to be paid back completely by all EU member states until 2060.

On Monday May 18, Angela Merkel and Emmanuel Macron proposed a €500 billion recovery fund plan for European economies to cope with coronavirus. The fund would be taken from the EU which borrows money from financial markets via issuing debts and distributed to countries and businesses impacted by coronavirus as grants instead of loans. And the debts would not be expected to be paid back completely by all EU member states until 2060.

![]() On Wednesday May 20, the UK three-year gilts yields dropped to -0.003%, marking the first time that the UK short-term bond yield fell below zero, sending signals that the market is expecting BoE to further expand its bond purchase programme, or possibly introduce negative interest rates.

On Wednesday May 20, the UK three-year gilts yields dropped to -0.003%, marking the first time that the UK short-term bond yield fell below zero, sending signals that the market is expecting BoE to further expand its bond purchase programme, or possibly introduce negative interest rates.

![]() On Friday May 22, China proposed a national security law for Hong Kong during the China National People’s Congress meeting. Once passed, the law will give Beijing more control over Hong Kong, including the power to criminalise any acts related to treason, secession, sedition and subversion in Hong Kong.

On Friday May 22, China proposed a national security law for Hong Kong during the China National People’s Congress meeting. Once passed, the law will give Beijing more control over Hong Kong, including the power to criminalise any acts related to treason, secession, sedition and subversion in Hong Kong.

![]() Bank of Japan held an unscheduled meeting on Friday and announced a loan programme that will offer $279bn to help small and medium sized businesses impacted by Covid-19. The interest rate was kept unchanged at -0.1%.

Bank of Japan held an unscheduled meeting on Friday and announced a loan programme that will offer $279bn to help small and medium sized businesses impacted by Covid-19. The interest rate was kept unchanged at -0.1%.

![]()

![]()

![]() Germany GDP growth will be released on Monday May 25, at an expected rate of 0.30% YoY.

Germany GDP growth will be released on Monday May 25, at an expected rate of 0.30% YoY.

![]() Germany IFO Business Climate index will be published on the same day Monday May 25, expected at 78.6.

Germany IFO Business Climate index will be published on the same day Monday May 25, expected at 78.6.

![]()

-0.85*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 15/05/2020

Notice:

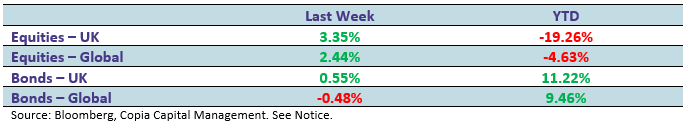

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.